Special Warranty Deed Templates

A deed of warranty is a powerful tool for protecting your interests when selling land or real property. A deed comes in several types, all of which offer varying degrees of protection against claims from third parties.

To know what level of protection your property enjoys, you need to know what type of deed you have. We will look at a special warranty deed.

Special Warranty Deed By State

What Is a Special Warranty Deed?

A special warranty deed moves ownership of real property from one person to another. This type of deed guarantees no defects or problems with the title during the seller’s ownership period. Still, it makes no promises about the condition of the title before the seller owns the property.

A special warranty deed protects the owner against any problems that occurred when they owned the property. However, it does not apply to everything that happened before the owner purchased the house because they don’t know everything that occurred before then.

It does not provide as much legal protection as a general warranty deed, but it does ensure that the grantor is the legal owner of the property title. It also guarantees that the property was not somehow encumbered while the grantor had ownership.

Are a General Warranty Deed and a Special Warranty Deed Different?

A general warranty deed offers more protection than a special warranty deed. The general warranty deed covers all of the property’s history, while the special warranty deed only covers the property of the previous owner’s time.

What Are the Types of Special Warranty Deeds?

There are three main uses of special warranty deeds.

- Estate transactions: A special warranty deed may be issued when the person responsible for administering the estate has no idea about the property’s history.

- Commercial transactions: When companies buy or sell properties, they often give the buyer a special warranty deed. When you are dealing with businesses, these are called commercial transactions. For example, if Apple sells a building to Microsoft, the company is aware of any title issues that might have existed during their ownership of the building. However, they may not know about any title issues that may have existed before they owned it.

- Foreclosure transactions: When you buy a foreclosure, you have to be especially careful. A great way to do that is to find out if the property has been foreclosed on before. Then, check to see if there are any new liens or other issues. If the property has been foreclosed on before, then be sure to pay back taxes and additional fees to whoever foreclosed on it.

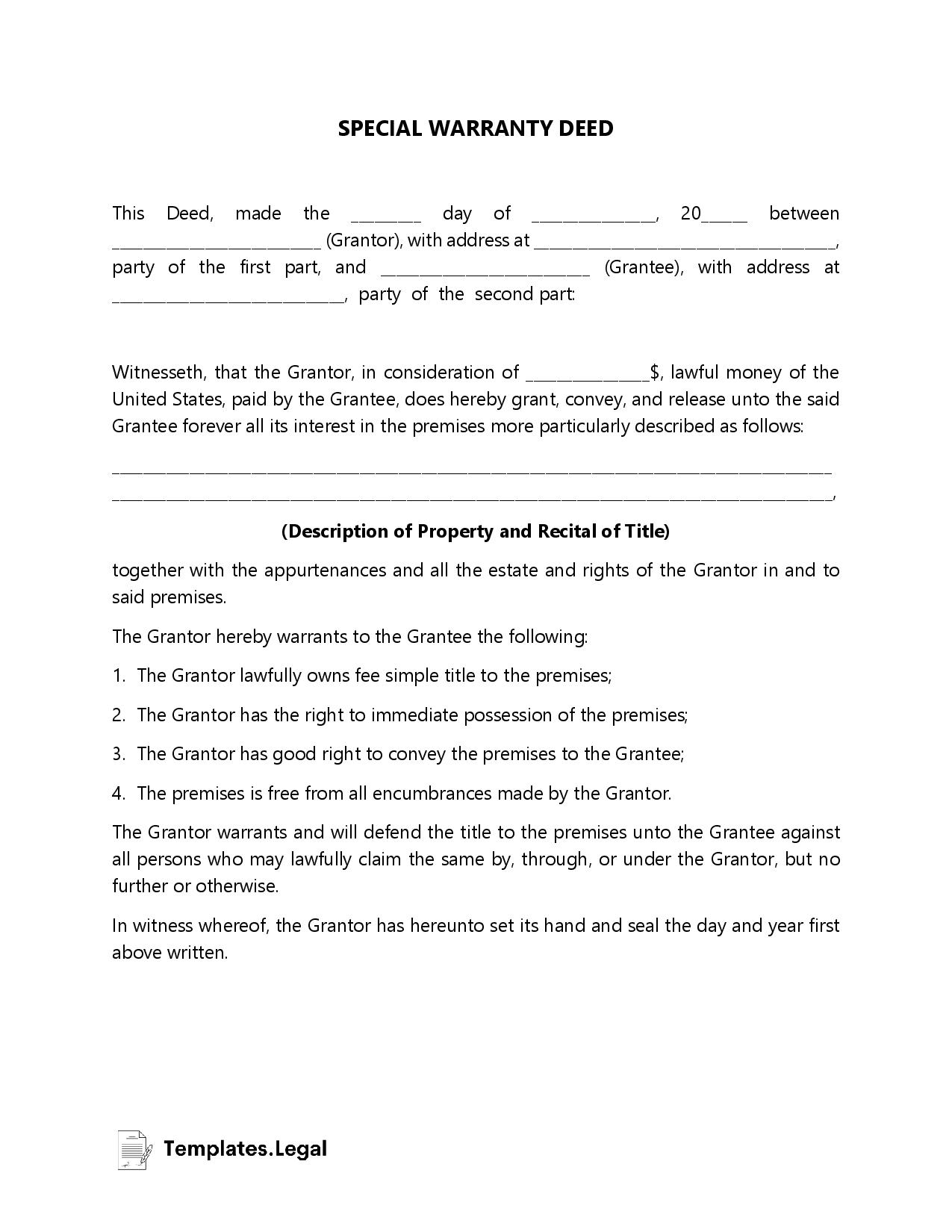

Special Warranty Deed Example

In most cases, general warranty deeds are for residential real estate transactions. However, there are exceptions. Examples of a special warranty deed are when the property gets foreclosed, real estate owned or REO, or short-sold properties.

How to Obtain a Special Warranty Deed?

To get a warranty deed, you must go through your real estate agent or download a template from the web. Warranty deeds include:

- The date of the transaction.

- The names of the parties involved.

- A description of the property getting transferred.

- The buyers’ signatures.

To obtain a special warranty deed, you must:

- Check records.

Before you buy a house, check it online. The best place to start is at the county courthouse. This search will pull up all public records associated with the property. This includes tax reports, liens, title history, and mortgage records.

- Get the special warranty deed forms.

When selling your home, you are the grantor or property owner, and the buyer is the grantee. You can use a local realtor to obtain a warranty deed for the transfer of your home. Or, you can find a special warranty template online and complete the document yourself. These free special warranty forms are easy to fill out.

- Fill out the forms correctly.

When selling your home, you are the grantor or property owner, and the buyer is the grantee. You can use a local realtor to obtain a warranty deed for the transfer of your home. Or, you can find a template online and complete the document yourself.

- Sign it in front of a notary public.

For the deed to be legal, it must be signed and stamped with a notary public.

- File the forms with the county recorders.

Before you file your Warranty Deed, be sure that the County Recorder’s office has signed it. This is an official seal that verifies that all taxes have been paid in full.

Other Considerations When Obtaining a Special Warranty Deed

To be considered a special warranty deed, the paper must state that the grantor is the property owner and has the right to transfer it, that the grantor owns the house, free and clear. The grantor guarantees he has a clear title only during his period of ownership. It does not cover the time before this period and is not liable for any liens before he owned it.

The special warranty deed must be created following state law. In some states, such as Alabama, a statute expressly authorizes the creation of such a deed. In others, like Michigan, they are generally accepted. In addition, the deed must consider the other elements that must be satisfied for the deed to be effective.

A legal deed must have an accurate legal description. It should list the consideration for the transfer of ownership or state that there is no money involved. If there is more than one grantee, it should indicate how they will share ownership of the property. The deed must also include correct font size, page margins, and other page format requirements. Lastly, it requires a signature block and a notary acknowledgment that comply with.

Conclusion

Buying and selling a home can be expensive and confusing. But you can make it easier by breaking the whole process into steps, using online forms, and checking all the paperwork so you can catch any mistakes before the papers filing with the courts.

A limited warranty deed is helpful in the event of a foreclosure. It offers some guarantees to the buyer, but not as many as a complete warranty deed.