Minnesota Promissory Note Templates

A Minnesota promissory note isn’t uncommon. Think of it as a written formal “promise” between two parties. This includes the borrower, who borrows money, and the lender, who lends a loaned amount of money to the former.

In this written agreement, the borrower agrees to pay the overall balance in a specific timeframe, including the accrued interest.

These promissory notes are beneficial for both the lender and the borrower. They clearly state expectations while emphasizing a repayment plan.

In the state of Minnesota, if an interest rate isn’t listed on the promissory note, there’s a usury rate (or legal interest rate) of 6%, according to the state’s legislature. However, the usury rate with promissory notes is 8% unless the loan is more than $100,000.

There are two types of Minnesota promissory notes: secured or unsecured.

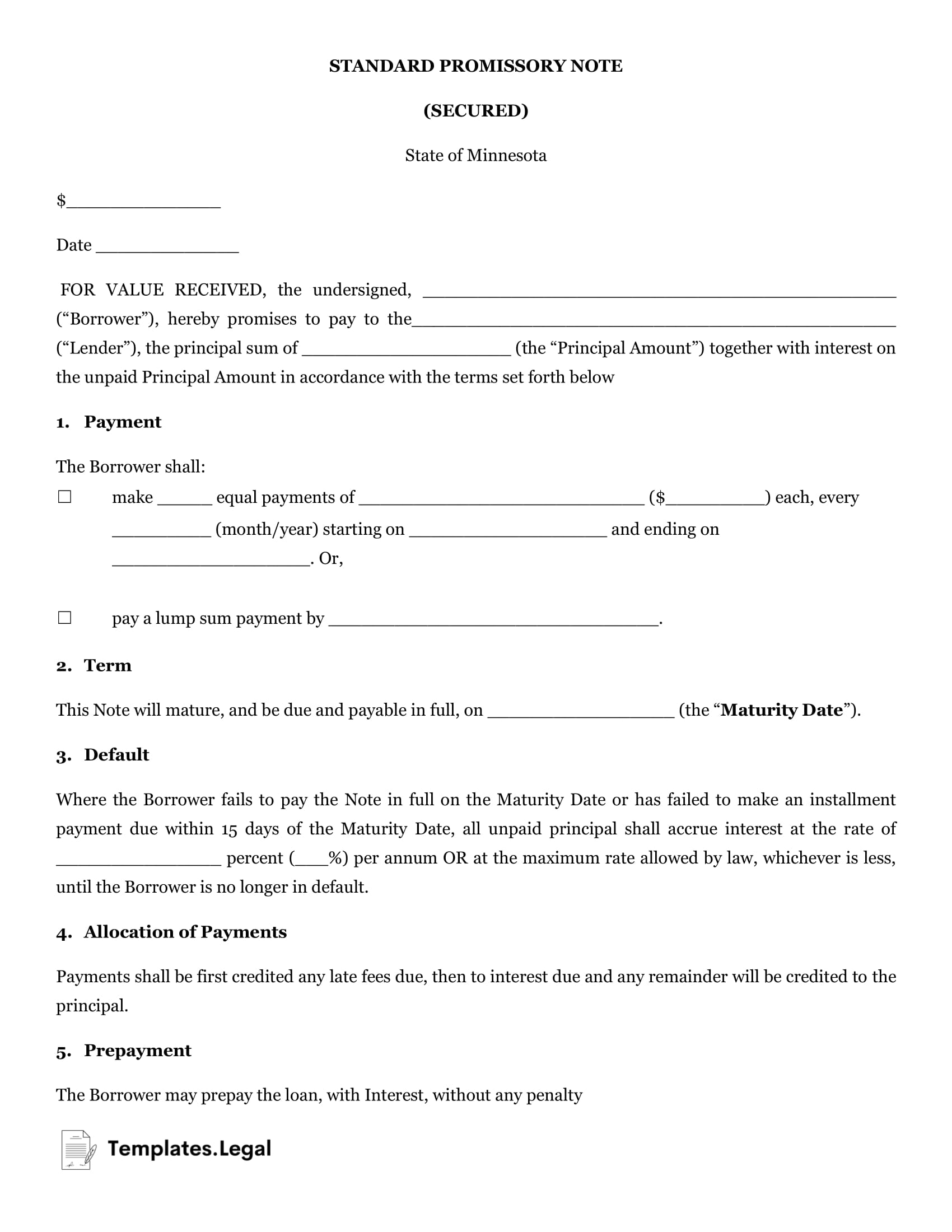

Minnesota Secured Promissory Note

A secured promissory note means the borrower promises to give the lender collateral if the borrower shirks their agreement. The collateral — also called security — is usually in the form of assets.

The promissory note template for Minnesota is easy to follow. When you write a secured promissory note, you’ll include:

- Opening information, like the date, the name and address of both the borrower and lender, the total of the loan and the interest rate

- Payments

- The due date

- Interest due in case the borrower evades the note or loan

- Late fees

- Acceleration, or how long the borrower has to fix a default on the loan

- Security

- Signatures

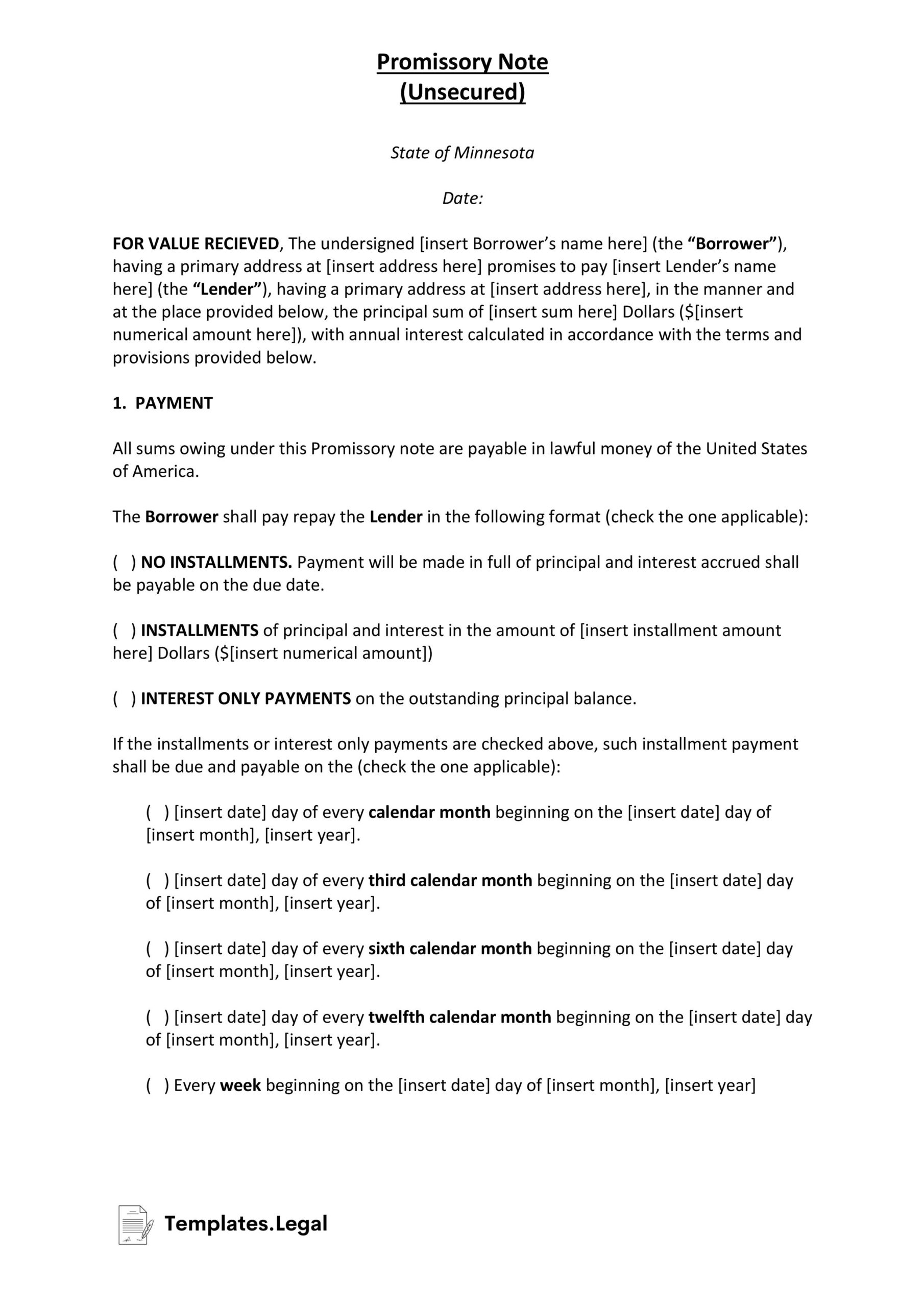

Minnesota Unsecured Promissory Note

A Minnesota promissory note that’s unsecured doesn’t include any type of security or collateral. Because of this, the lender might be at a higher risk of losing the loaned amount of money.

With unsecured promissory notes, lenders should make sure the borrower in question has a history of good credit. People who choose to go with unsecured promissory note Minnesota forms are usually lifelong friends or family members. You can use a free Minnesota promissory

note form to make up an agreement at your convenience.