Pennsylvania Promissory Note Templates

Lenders and borrowers in the Keystone State can use a Pennsylvania promissory note as a written contract between them. The note becomes the document that shows the details of the loan and repayment agreement. A promissory note can be secured or unsecured.

The Pennsylvania promissory note gives the lender tools for legal action if the borrower defaults on the loan.

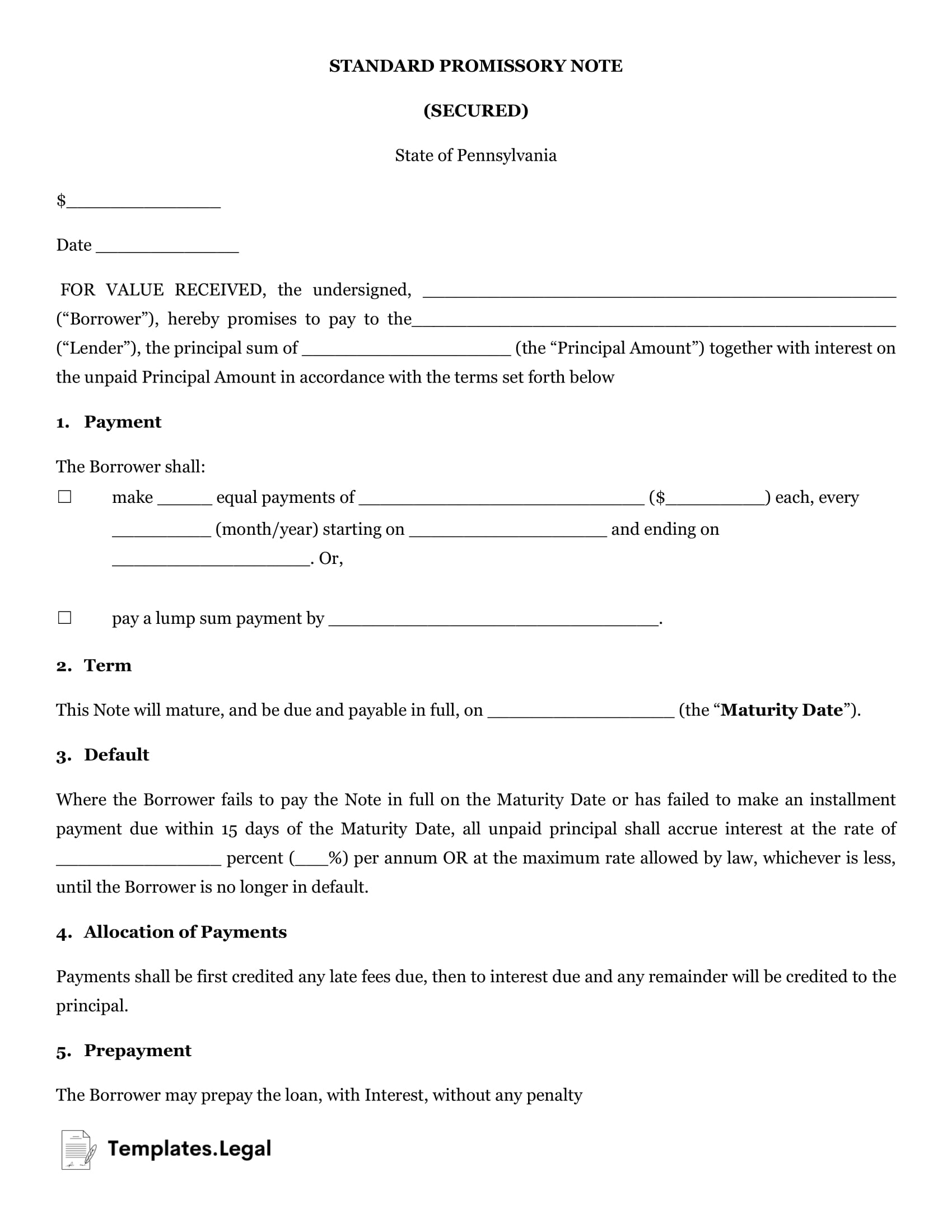

Pennsylvania Secured Promissory Note

When signing a secured promissory note, the borrower agrees to put collateral toward the loan. This is to cover the loan if the borrower defaults on the agreement.

When you need to record a promissory note in Pennsylvania, you need a free Pennsylvania promissory note form. The form needs to include several features:

- Term and interest

- Collateral

- Conditions of the loan

- Fee and default information

- Amendments

- Signatures of lender and borrower

- Signature of witness

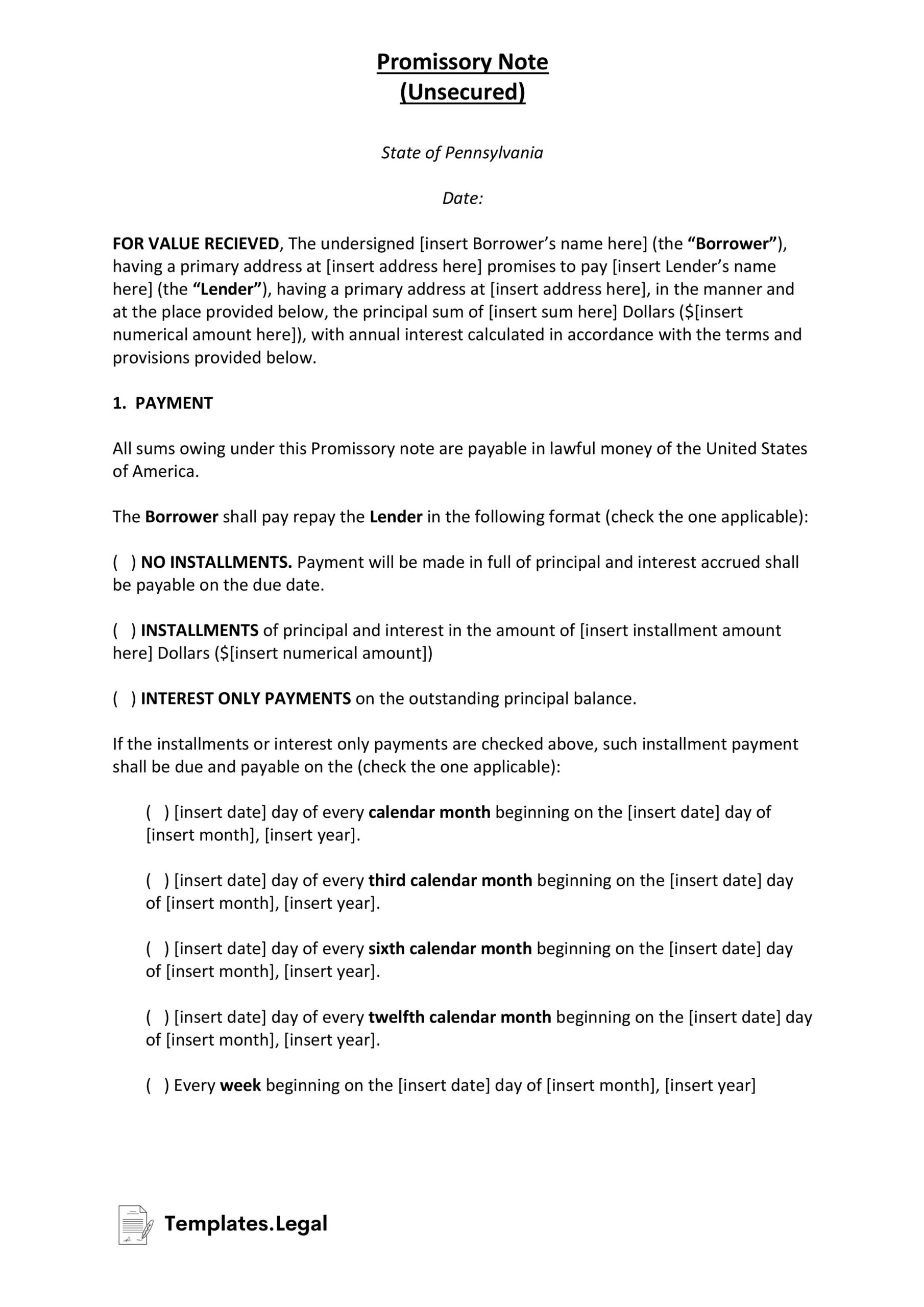

Pennsylvania Unsecured Promissory Note

An unsecured promissory note is an agreement that does not include collateral. This could be an agreement between a lender who deems the borrower to have good credit.If the note is unsecured, the first step is to file a legal petition in the courts. Once you get a judgment, you can hire a collection agency to pursue the borrower.

Unfortunately, getting a court judgment in your favor does not guarantee you will receive payment from the borrower.