Alabama Promissory Note Templates

An Alabama promissory note is an agreement between a lender and borrower for the repayment of a loan. A promissory agreement in Alabama can include information about the terms of the loan and the repayment structure.

When you Alabama promissory note, you have two options. The promissory note template Alabama uses depends on the type of agreement.

There are unsecured Alabama promissory notes and secured promissory notes. Alabama promissory note needs to abide by state usury laws, which say that the maximum interest rate for verbal or non-written contracts is 6% per year, and the maximum interest for written promissory notes is 8% per year.

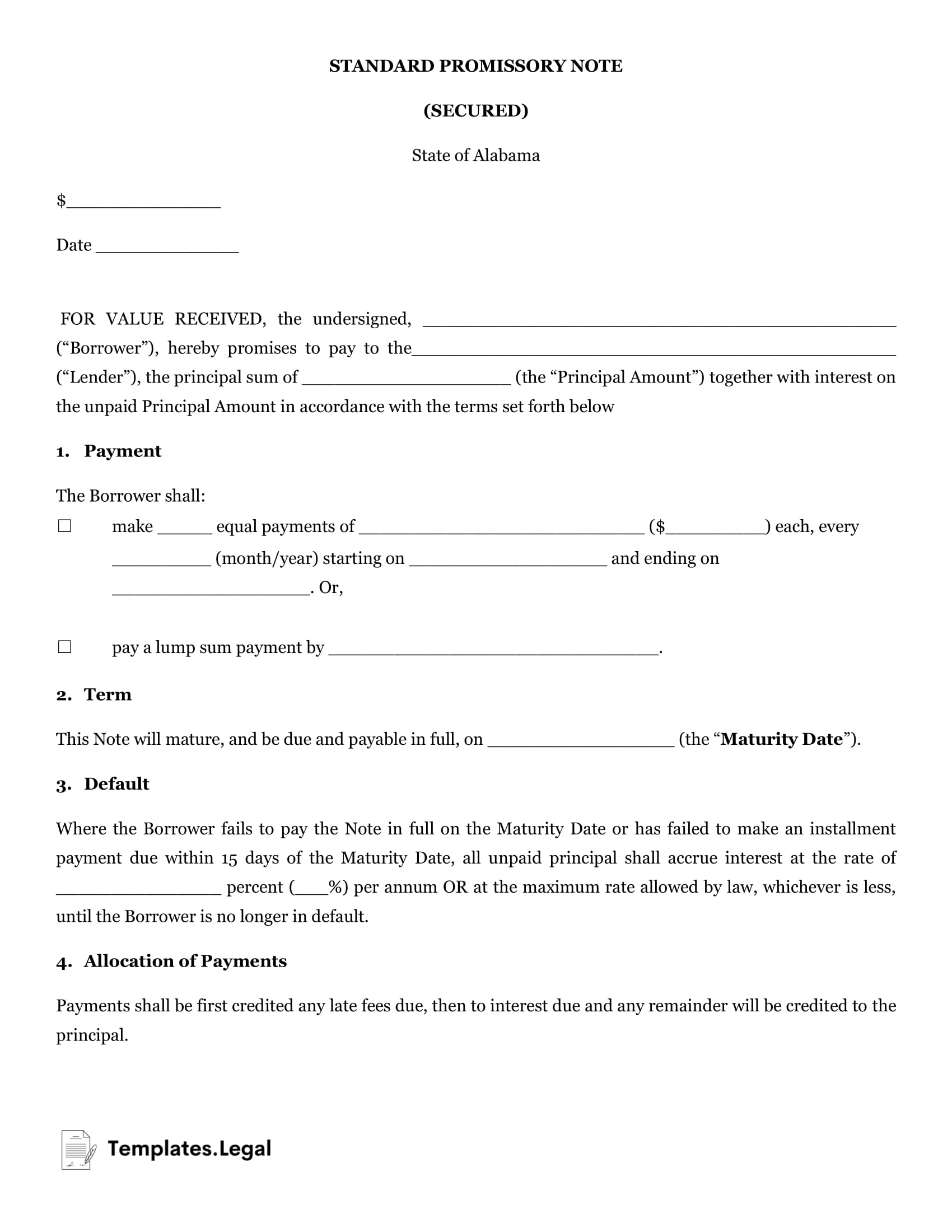

Alabama Secured Promissory Notes

In Alabama, a secured promissory note is an agreement that includes collateral. With this promissory note, the lender gets to take possession of the item(s) that the borrower puts up as security for the loan if the borrower does not repay the loan in full.

A promissory note Alabama form for a secured loan will require that you fill out the information about the type of security and the terms that the borrower needs to meet to retain the items that they put up as security.

A secured promissory note will include the borrower and lender’s information, the amount loaned, the repayment terms, the due date, and information about what happens in case of a default, late payment, or other breaches of the agreement.

You can find a free Alabama promissory note template to help you include all the necessary information.

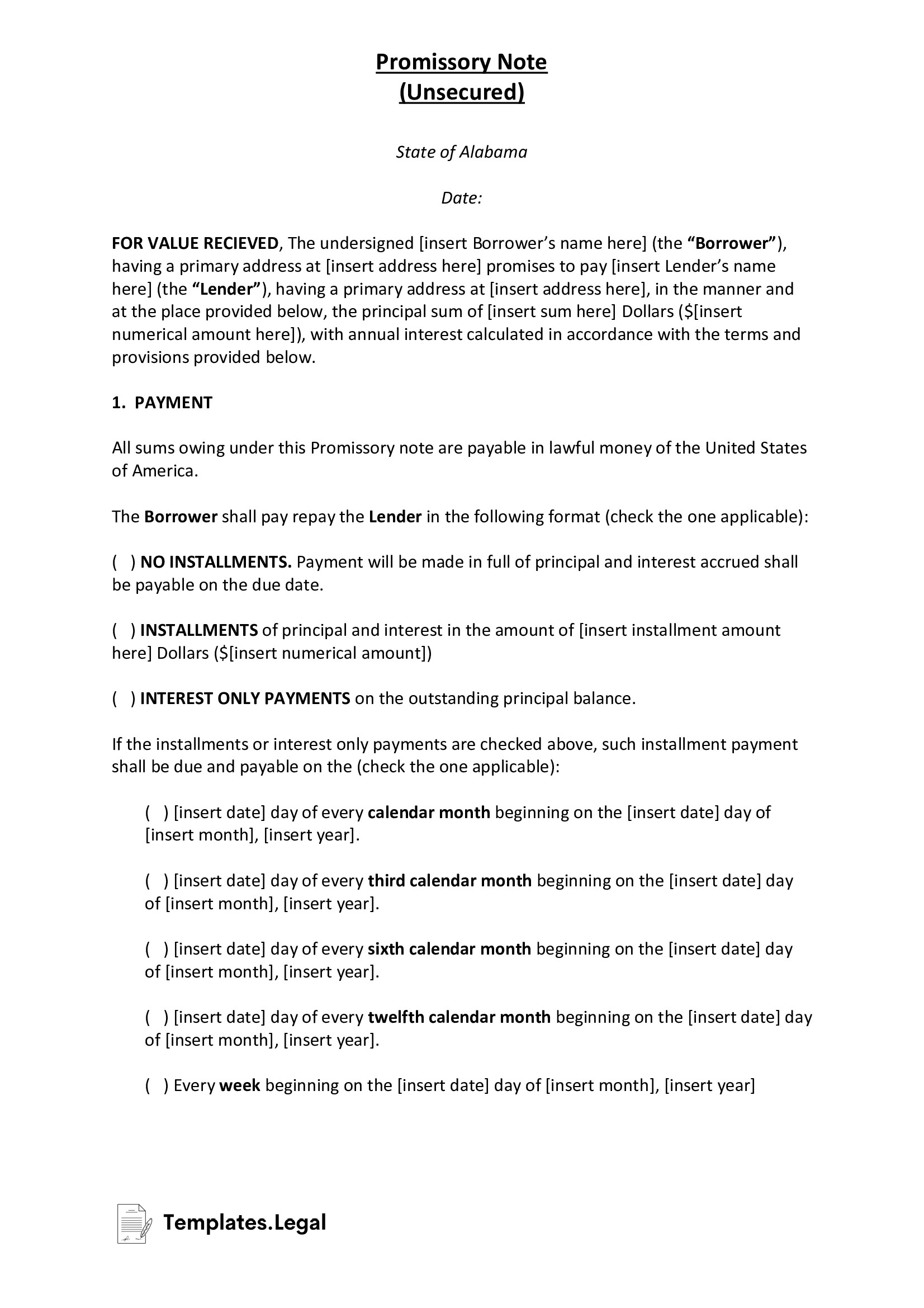

Alabama Unsecured Promissory Notes

An unsecured Alabama promissory note is for a loan where the lender does not provide collateral. An unsecured promissory note still contains the details about the loan, but it does not have a section on items that the borrower uses to secure the loan.

The type of unsecured promissory note template Alabama uses includes information about the borrower and lender, the due date for payments, and the amount of interest that the lender can charge.

Also, there is a section about any penalties or actions that the lender can take if the borrower does not pay back the loan as agreed.

Frequently Asked Questions

Here is some additional information about promissory notes in Alabama.