Power of Attorney Templates

Power of attorney is a legal document that gives a person the power to act on another person’s behalf. The majority of the power resides in decision-making over finances, medical care, or property. In legal terms, the person appointed with a power of attorney is an agent, while the person handing over these decisions to the agent is the principal.

When people think or hear about power of attorney, they think of a principal fighting an illness or dealing with a disability that limits what they can do. But other factors make establishing a POA a vital action to take, for example, if a principal cannot legally sign documents or handle a financial transaction in person.

Obtaining a POA is a serious and multistep process that can vary depending on the type and the state that the principal resides in. It is difficult due to the power and control it gives the agent over the principal’s assets or business dealings. A principal must appoint someone that they can trust and are confident in their capabilities.

What is Power of Attorney?

Officially, power of attorney is a document and legal agreement that lets another person, often called the attorney-in-fact or agent, make decisions about them. Depending on the type of power of attorney form, this could include medical decisions, choices surrounding financial transactions, or even taking custody of a minor for an extended period of time.

Power of Attorney By Type

It is essential to know the different types of power of attorney there are, so the principal can better select which one will work for them. As expressed before, most people think of finances when discussing POA, but other circumstances may also need a POA. The four different POA types are durable, limited, medical, and minor(child).

Durable Power of Attorney

A durable power of attorney is very similar to a general POA. A durable power of attorney means that the appointed will still have complete control of the principal becomes incapacitated. This issue can happen through illness or just a simple accident.

Most principals that live a particular way or have declining health may consider having a durable POA. It is also important to note that the principal can make a current POA durable at any time. If anything changes for the principal, they can revoke it or strengthen the POA by making it durable.

Suppose the principal has failing health and does not make their POA durable. In that case, their family members will have to go through court to officially declare the principal mentally incompetent to manage specific tasks for the principal, like their bills, property management, filing tax returns, or apply for government benefits.

A durable POA can cut a lot of grief and confusion for the principal’s loved one in the future.

General Power of Attorney

Some people may confuse durable power of attorney and general power of attorney since they grant similar powers to the attorney-in-fact. Like durable power of attorney, general power of attorney gives an individual the authority to handle financial affairs, business transactions, and even a limited scope of medical decisions.

However, there’s one major difference between the two. While a durable POA remains effective if the principal becomes disabled or incapacited, a general POA becomes automatically void. A physician will have to declare the principal incapacited, but once they do, the POA is no longer effective.

Some individuals may prefer to use a general power of attorney over a durable POA since they don’t need to worry about their agent making poor decisions while they’re incapacited.

Still, even with this built-in fail safe, the person that a principal picks for their general power of attorney agreement should still be someone they trust completely.

Limited Power of Attorney

Limited Power Attorney is also known as LPOA. This kind of POA is popular for those who are invested in business dealings together. It permits a portfolio manager to invest or move around funds on behalf of the account holder.

A portfolio manager is a person or group of people who use investment strategies, like investing in a mutual or just managing everyday tasks that deal with portfolio trading.

An LPOA allows the portfolio manager to do this easily without consulting the account holder every time. It keeps business running smoothly without contacting the account holder multiple times throughout the day for minor, expected transactions like these.

The portfolio manager cannot withdraw the account holder’s funds for the account holder’s safety and funds. They also cannot transfer the POA over to somebody else. If the account holder remains considered, they can always limit what the portfolio manager can do with their funds.

Medical Power of Attorney

As the name suggests, the medical power of attorney concerns the health condition of the principal. If the principal’s health is declining, they can appoint an agent to make specific medical decisions if they are somehow incapacitated.

In many states, they have strict exclusions on persons that cannot act as an agent. These people are the principal’s physician or any employee associated with their healthcare provider. Many people choose their close family or friends as agents.

The principal should speak with the agent before giving them medical POA. They may have to make a life-changing decision for their life and health. They also briefly talk with the agent to discuss what choices they would make in particular circumstances.

Like a POA to obtain a medical POA requires written consent from the principal that’s notarized.

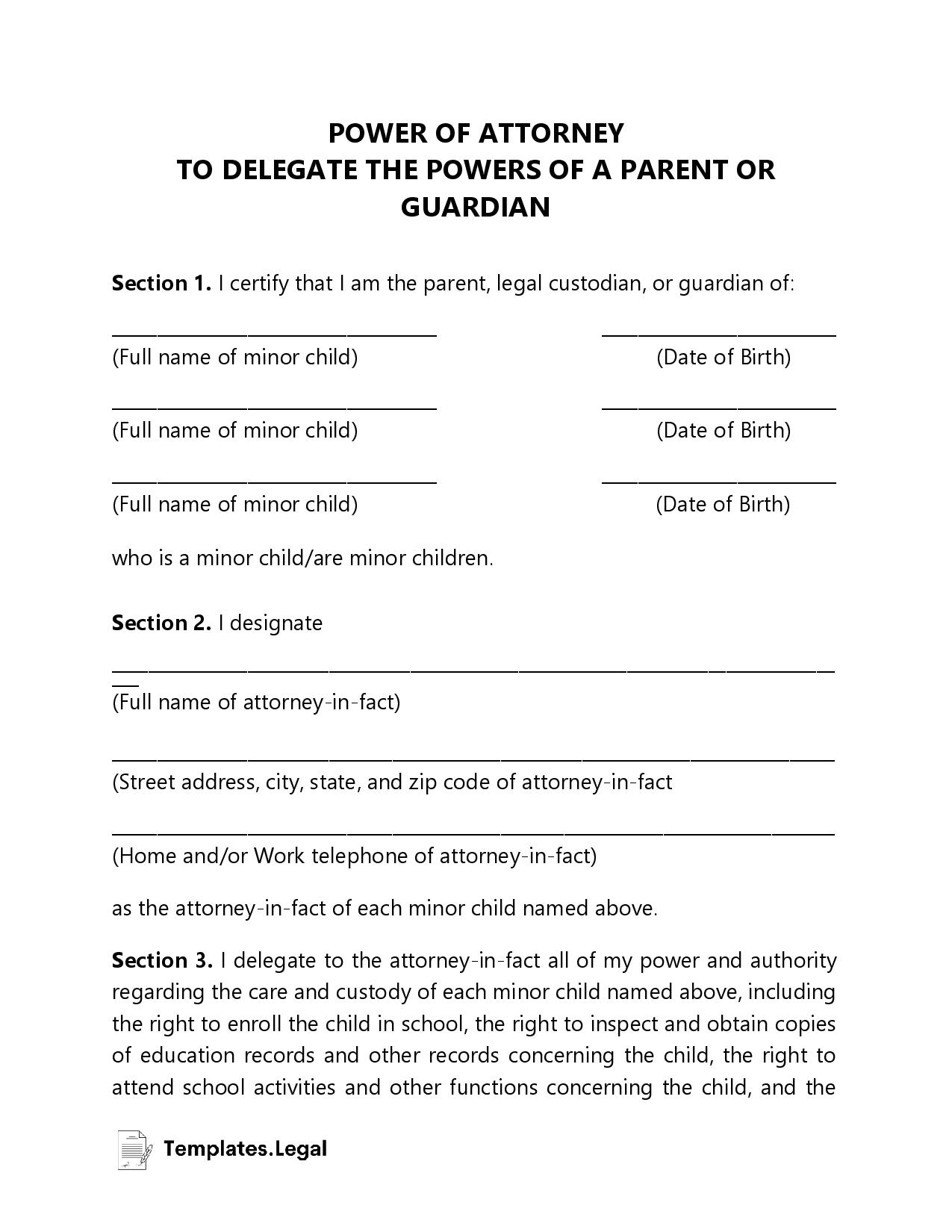

Minor (Child) Power of Attorney

This kind of POA gives parental rights to another person temporarily. In most cases, it receives parental rights. Even if it is temporary, the state court system has to be involved. A Minor Power of Attorney does not use the court system to legitimize it.

These POAs are common when the parent is away from the child but wants to ensure that they get the proper care until they return. Parents usually grant their close relatives this POA, especially in situations where one or both parents are in the military.

A minor POA can also be used on smaller occasions, like if the parents are traveling somewhere else long-term or if they need a long-term babysitter or caregiver for some reason.

It is also essential to look up how these POAs work within the residing state. In some cases, it requires more than a public notary. The agent or temporary guardian may have to produce the public notary on top of other certain documents to make decisions and perform specific tasks, like picking up the child from school or consenting and seeking medical care.

Power of Attorney By State

How to Get Power of Attorney

It’s a common misconception that getting power of attorney requires the assistance of a lawyer. While it is a legal document and a lawyer can be helpful in defining POA agreements in certain situations, you don’t need one. In fact, there are plenty of power of attorney templates and free power of attorney forms available on our website!

You can either draft your own document with a lawyer or use a template below – but both the attorney-in-fact and the principal must willingly sign the document, and understand what it represents. In most states, you’ll usually need two adult witnesses or a notary public to render the agreement valid.

Step-by-Step Guide to Creating Power of Attorney

Although we’ve given a brief overview of how to obtain power of attorney above, here’s the step-by-step guide for creating one of these documents.

- Decide who should be your agent or attorney-in-fact.

Once you know you want or need a POA, the first step is deciding who your agent should be. Regardless of the type of POA, this should always be someone you trust, and preferably, someone who lives close by. Many people pick family members or spouses, who they know will honor their wishes and act in their best interests. The agent also has to be willing to be your POA, so you’ll need to pick someone who wants to help.

- Choose how much authority you’ll be granting your agent.

You’ll need to decide how much authority to give your agent. Some people may only give their agents control over specific business transactions, while others let their attorney-in-fact deal with their financial affairs and make medical decisions.

- Draft your own or obtain a free power of attorney form.

Although you can draft your own POA form with a lawyer, it’s often easier to get a free power of attorney sample online. Templates.Legal contains dozens professionally written power of attorney templates.

- Execute the document.

Once your agent has agreed to help and you’ve got the form, it’s time to make it legal. Both parties will need to sign, and understand the full scope of what they’re agreeing to. To make it legal, your state will most likely require a notary public to give their stamp, or two adult witnesses.

- Make copies and distribute them.

After everyone has signed and the agreement is valid, you should make several copies and distribute them to all the involved parties. Some banks or financial institutions may also require a copy of the document for their records.

FAQs

These FAQs can help answer your lingering questions about PoA and how it all works.