Purchase Agreement Templates

It’s essential to have written agreements when detailing important transactions between two or more parties. These prevent disputes and may be legally permissible or enforceable by a court of law. So how do you create a purchase agreement template that can easily be shared, filled in, and downloaded by all involved individuals?

A purchase agreement outlines the conditions of sale for high-value items to give assurance to a buyer or a seller. Also known as sales contracts, such agreements provide transparency and ensure both parties follow the agreed-upon terms. They can be used for any transaction but are typically utilized when the item’s value is above $500.

Often used for property transfer and real estate transactions, a purchase agreement outlines prices and other conditions that the transaction must meet. For instance, it could include the property’s description or how the down payment is made before both parties can append their signatures. In this article, let’s explore type-specific document templates with steps on how you can make each one.

Purchase Agreement Template

Purchase Agreement by State

What Is a Purchase Agreement?

When a potential buyer and seller define the terms or conditions for an item’s sale, it’s called a purchase agreement. The legally binding document governs the occurrence of such transactions, safeguarding against unexpected events or potential hiccups. In addition, it helps avoid back-end legal or financial hurdles. An agreement’s completion and signing put the buyer, seller, and item for sale under contract.

For example, if the purchase agreement is for real estate, the buyer proposes the contract’s conditions to which a seller negotiates, agrees, or rejects. The buyer’s agent also prepares the document, or a seller’s agent may use standardized templates for buyers to fill in the sale specifics. Often, they start as purchase orders, and for less complicated transactions, you can use a receipt or bill of sale instead.

Before goods are transferred or any payments are made, both a buyer and the seller must sign a purchase agreement. Otherwise, without the signatures, especially for complex transactions where goods are delivered and paid for over a lengthy period. Agreements consist of relevant information to the transactions that might include;

Details of the buyers and sellers, including names and contact information

- Item or goods being sold and transferred

- Type of sale and terms of delivery, if applicable

- Cosigners and whiteness information and contact details

- Details of the sale, including price, quantities, dates of agreement fulfillment

- Whether any revisions or amendments to the agreement are allowed

- Options in the event of disputes

Purchase Agreements By Type

Purchase agreements are made from the buyer to a seller in orders and become a binding contract when they’re accepted and signed. After that, it’s a request from the buyer’s agent for detailed specifics of the order.

Primarily, purchase orders that escalate to agreements include planned, standard, contract, and blanket. Disparities among these depend on how much information is known about the order when the agreement is written. Your contract has the potential to be unique beyond these four types and as particular as the project or transaction in question.

However, your purchase contract template must clearly outline the responsibilities of both parties to complete the transaction. Once signed, the only way to get out of it is by breach of contract, which has its own set of legal ramifications. Once you learn their formats, your agreements are customized for variety with the necessary transactional components to your liking.

Real Estate Purchase Agreement

A real estate purchase agreement consists of a binding contract between a home buyer and a seller. It includes details such as the property or home for sale’s condition while stipulating the responsibilities and rights of each of these parties. The contract doesn’t represent or act as a transfer of title or ownership but sets the transferring attributing terms.

Also called a real estate purchase contract, the agreement is a buyer’s proposal for the property, including their offer price. A seller will agree, reject or make a counter negotiation, and these can include issues like;

- Naming a higher price for the property

- Earnest money or down payment requirements

- Reject the covering or assisting in covering closing costs

- Revised periods for or refusal to meet contingencies

- Exclusions of personal property or utilities from the agreement

- Writing a real estate purchase agreement

A real estate contract sets out the terms of a property sale or transfers under an agreement. It’s required before any title or keys are handed over to a buyer. You can use a purchase agreement template that outlines each party’s responsibilities by following steps which include;

- Identifying the property’s details such as address and required legal descriptions

- Names and contact information of both the seller and potential buyer

- Terms of purchase and details on the price of the property

- Closing date, tax payments details, and who pays for the costs

- Additional items like equipment or furniture being sold with the property

- Required disclosures on the property, including hazardous materials like lead paint or asbestos

- Any details of contingencies to the sale, including pending appraisals, inspections, or requirements that could negate or delay purchase

Business Purchase Agreement

When buying or selling an enterprise, a business purchase agreement is the best document to use. Such a contract outlines the conditions associated with the transaction, allowing for meaningful market valuation and fair pricing. Also known as BPAs, these agreements oversee the legal transfer of an entity from a seller to a buyer.

A well-written BPA contains provisions that govern the sale of a business. It serves its intended purposes for both parties without resulting in unwanted legal consequences. Usually, a business purchase agreement initiates the binding contract of sale after the seller receives a letter of intent or LOI.

Outlined within a BPA are the business’s sale price, warranties, and optional clauses, including assets, shares, or liabilities the entity might have. Besides the contract drafting, which should be left to legal professionals, standardized provisions in these complex documents to familiarize with? These will include items like;

- Description of parties involved in the transfer of a business entity

- The businesses description or seller’s representation and warranties

- Definition of the type of sale, including identification of included and excluded assets

- Transfer of property or buyers agreement to purchase

- Identification of purchase price and buyers method of payment

- Covenant or assumption of risks and liabilities

- Transfers or transition

- Participation or absence of third party brokers

- Conditions, closing, warranties, and miscellaneous

At the end of a business purchase agreement, the buyer and seller sign the terms outlined in the presence of a representative. Notarization of the document can be done by an attorney, broker, banker, or other notary or witness.

Asset Purchase Agreement

Alongside the BPA, the asset purchase or sale agreement is another requirement for buying or selling your business. It’s one of the documents that finalize the transfer of a business’s assets, and the buyer can begin the due diligence process.

An asset purchase agreement or APA takes the terms agreed upon in an LOI and modifies them to include changes, additions, or other reflections. It’s drafted as issues relating to the buyer’s due diligence, and previous conditions are negotiated, discussed, and then finalized.

Every detail of the businesses sale and negotiations is covered in the asset purchase agreement, including;

- Price and feel allocations

- Closing information

- Transition and training assistance

- Taxes, inventory, assessments, and other prorations

- Buyer’s obligations to close and contingencies

- Warranties, representations, and covenants for all parties

- Damage and maintenance

- Notices, arbitrations, and indemnifications

- Brokerage, authority, and governing law

- Agreement completion, execution, and expiration dates

- Disclosures, confidentiality, and ongoing operations

Land Purchase Agreement

A contract between the buyer and owner of a piece of land is called a land purchase agreement or LPA. In most cases, the document is applied when the seller provides financing on the sale price to be paid back in installments. Characteristics that set one LPA apart from another are the stipulations of the payment plan, alongside any guarantees or covenants.

In a traditional land purchase and sale agreement, the seller holds on to the property’s legal title until the buyer pays off the closing price. Typically, this contract contains installment payments due at periodic intervals or a final balloon payment that satisfies the loan terms.

A properly executed LPA contains several fundamental aspects, including;

- The sales price in the case of a straight land contract

- Amount of down payment

- The interest rate for the seller-financed contract

- Payment amounts and due dates, including penalties

- Responsibilities of both parties

- Title settlement

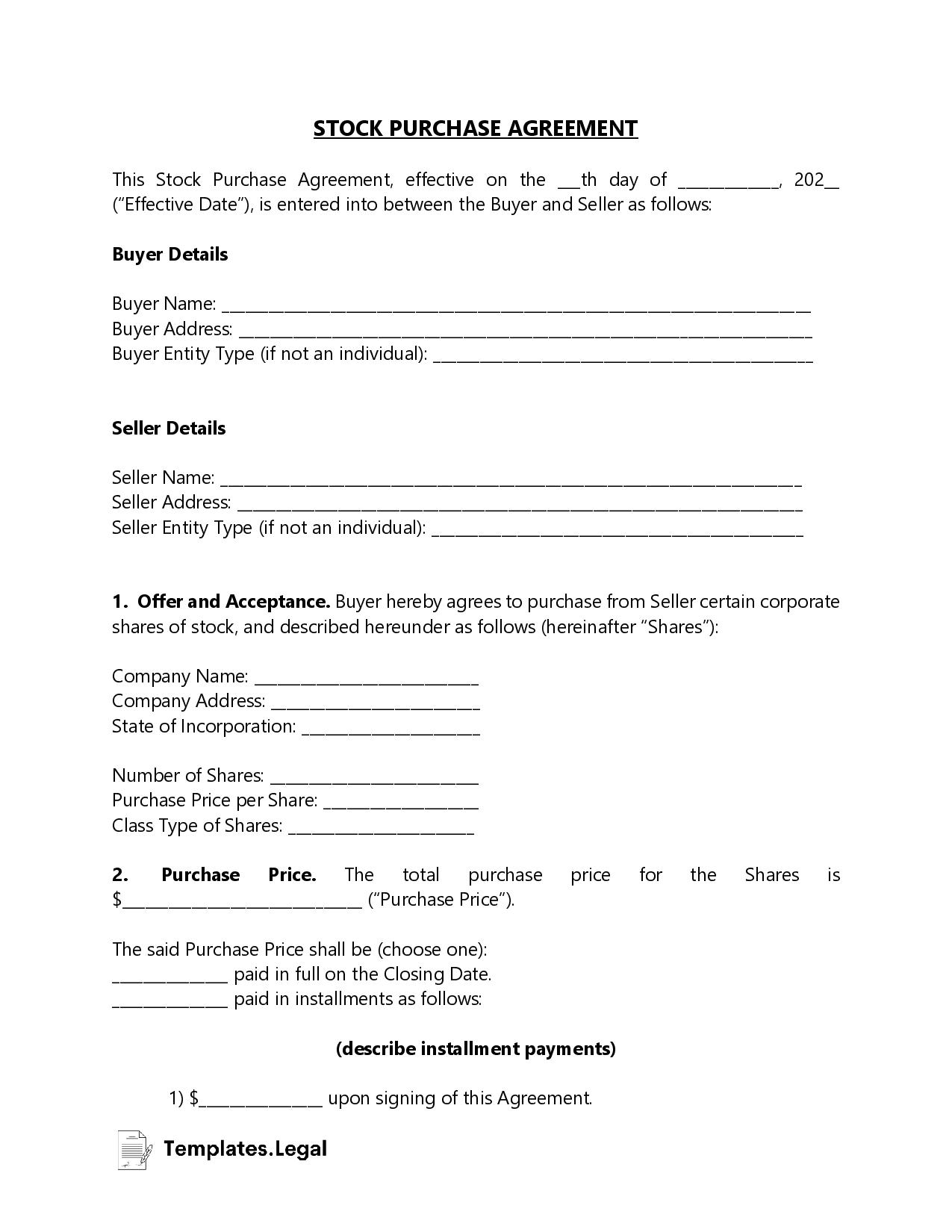

Stock Purchase Agreement

When buying or selling shares of a company, both parties will make a stock purchase agreement aimed at their protection. Unlike an APA, these agreements represent share sales to raise capital or transfer stock ownership. This document establishes all the conditions related to the sale and acquisitions while the stock’s listing terms and price are defined.

The primary goal of writing a SPA is risk mitigation and prevention; the document’s emphasis is on potential variables or situations that could jeopardize the investment. As a result, a buyer or seller has more faith in the transaction, and misunderstandings that could end up in the courtroom are avoided.

There are no standard formats for stock purchase agreements, and each document’s specifics are determined by the industry’s requirements, size, or nature. However, specific clauses aren’t often left out in a SPA, including;

Parties

The list of all the parties involved in the transfer of shares, including details of signing officers if one party is a corporation

Recitals

That’s the part of a SPA that outlines the buyer and seller, alongside the objectives of the transaction.

Definitions

You’ll find the definition of terms used in a stock purchase agreement, such as affiliate, average trading price, business day, and marks.

Considerations

One of the essential elements of a stock purchase contract includes the value that parties are exchanging. There’s also the sum payable or what’s included in the pricing formula, deposits required, and any security registration. You can also have amounts held in escrow, and here you’ll also list the needs for payment and how the buyer fulfills that.

Representations and Warranties

The seller makes statements about the shares and company, assets, liabilities, and status. It’s a transparent section that the buyer relies on to determine whether the sale is to proceed. For example, a seller includes their standing, company’s market reputation, rights over the shares, and number owned in that investment.

Buyers also make representations indicating their rights, corporate profile, and queries into subsequent stock purchase agreements.

Indemnification

If one party fails to fulfill a clause in the SPA, this section negotiates compensation and is also called the hold harmless clause. The part also indemnifies the buyer for any copyright infringement claims or intellectual property disputes arising from the stock transfer.

Force Majeure

The force majeure clause covers your bases in a SPA and removes liability for a contractor’s non-performance due to unforeseen occurrences. You may have suffered a sudden financial crisis because of lockdowns or catastrophic events like earthquakes, strikes, or tornadoes.

The final sections of a stock purchase agreement involve jurisdiction, termination, default, and dispute resolution clauses.