Business Purchase Agreement

If you plan to buy or sell a business, you need to understand business purchase agreements. These contracts are necessary when one wants to transfer ownership, so consider this your guide to business purchase agreements and how to draft one up for your business.

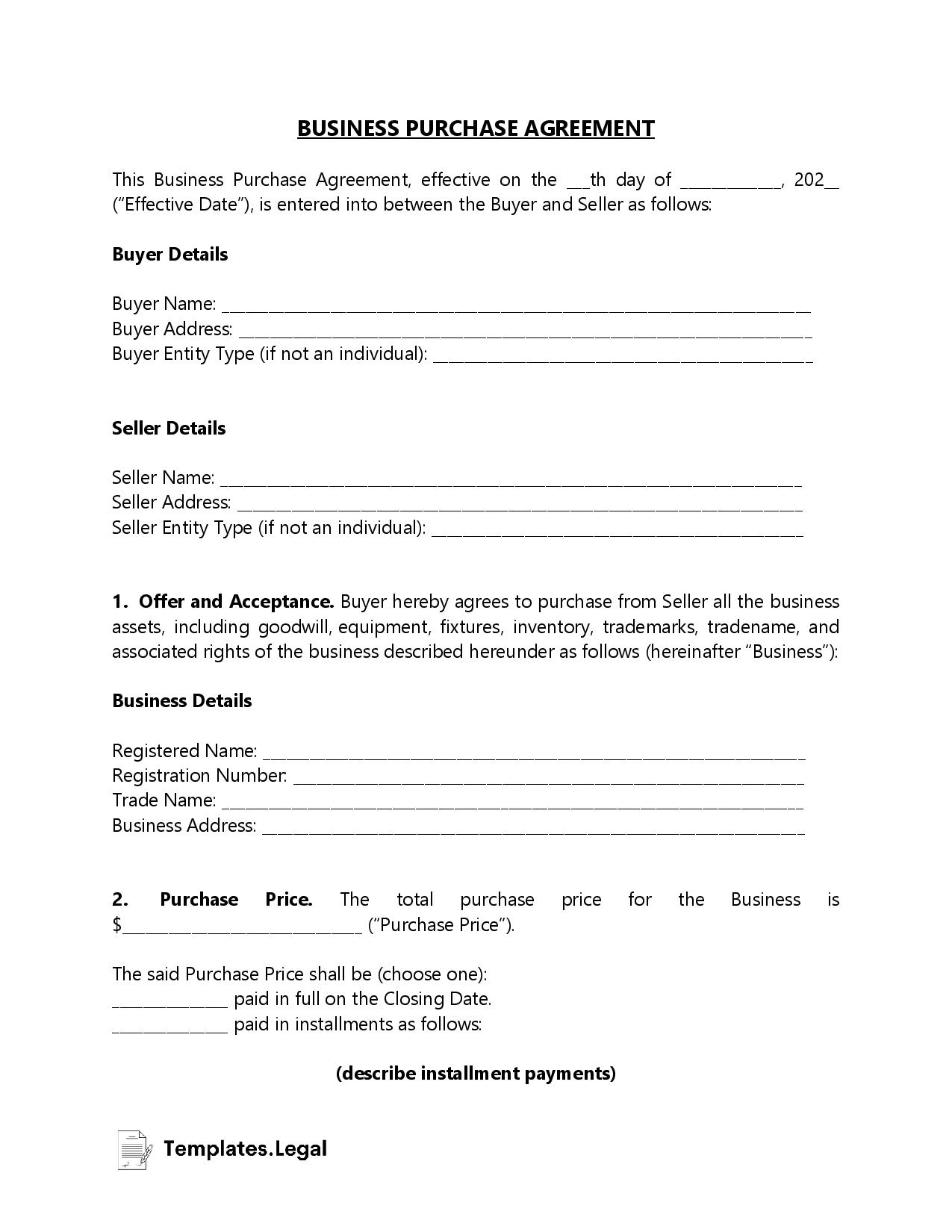

Business Purchase Agreement Template

Business Purchase Agreement By State

What Is a ‘Business Purchase Agreement’?

Business purchase agreements are simply the contract that officially and legally withdraws ownership of a business from the seller and places it on a new owner (the buyer). When people discuss ‘selling their business’, they will use a this contract.

In the business world, people often refer to these documents as BPAs.These contracts transfer ownership of not just real estate but all assets, finances, trademarks, and anything else associated with the business.

For example, if a small business owner wishes to retire from their small business, they administer a business purchase agreement. The purchase agreement will transfer ownership to another family member, close friend, or willing individual.

Another example is when a new business becomes a fast success, and larger companies become interested in acquiring the name and operations to better their own corporation. An example of a large corporation using business purchase agreements to become an umbrella company is Wexner Companies.

They began with the popular retail store The Limited but quickly acquired Abercrombie and Fitch, Bath and Body Works, and Victoria’s Secret soon after the stores launched and exemplified rapid success.

The owners of Abercrombie and Fitch, Bath and Body Works, and Victoria’s Secret signed BPAs to transfer ownership of their businesses to Wexner Companies.

Then, all business responsibilities and operations fall under the new owner, and the old owner is separated from the business, barring they don’t hold any shares.

If a BPA is not drawn up and signed by all parties involved, the official ownership of the business will remain the same, despite changes in operations.

The business sale contract legitimizes the transfer of ownership, which also transfers the responsibility of business taxes and any debts the business may have.

Steps to Draft a Business Purchase Agreement

If you’re wondering where to start, refer to the steps below. These steps will help you begin drafting a business sale contract the correct way.

- Collect All Information

A lot of information is necessary to draft a legally binding business purchase agreement. You’ll need the identify the business along with other relevant information. Collecting this information will help you complete the majority of this applicant.

The section below these steps details what information you must collect to fill in the contract. - Settle on a Price

Once the contract fully identifies the business and its assets, the seller and buyer must agree on a price. The buyer and seller can do this at their digression, or they can use mediators, negotiators, or arbitrators to arrive at a fair decision.

- Terms of Sale

The terms of sale portion will be the most complicated piece of the document. Terms of sale determine and detail representations and warranties for both parties, clauses that limit actions of both parties after-sale, and procedures if a dispute arises.

Terms of sale can differ wildly depending on the business and what the buyer and seller expect from the exchange. Some examples of terms of sale will be detailed in the section below. - Have it Reviewed (Optional)

This step is optional but highly recommended. Once there is a contract draft, you should have an attorney or accountant, preferably both, review the contract and give it the okay to sign. They can help explain complex aspects that you may not understand, helping you be fully aware of what you’re signing.

If you can’t or don’t want to hire a lawyer or accountant to review the contract, you should take the time to read the contract through and through on your own. But you may find yourself confused by complex clauses or legal jargon. - Sign

The last and maybe most important step is to have both parties sign. The business sale contract is not a legally-binding document until both parties leave their signature in the proper places on the document.

Sections of a Business Purchase Agreement

For a BPA to be legally binding, it must include the following sections with detailed information:

- Business Assets: The agreement must detail the cash, inventory, money in business bank accounts, property, and any other assets within the business.

- Business Liabilities: Any debts associated with the business must be represented.

- Business Identity: The contract must describe the business, whether it’s retail or otherwise, and state the name or names associated with the company.

- Closing Date: The official date when the purchaser will pay and the seller will hand over the assets must be clearly stated.

- Parties: The contract must identify the seller of the business and the purchaser of the business.

- Purchase Price: This section details the agreed-upon price the buyer will pay the seller for the business and all assets, including any deposits or financing.

- Representations and Warranties: These terms mean both parties sign assuming all information is accurate. Each party relies on statements of fact or promises concerning the business and authority to enter the transaction.

- Signatures: The contract must receive a signature from both eh buyer and seller before it is legally binding.

Optional Terms and Clauses:

- Confidentiality Clause: This clause states that both parties agree not to share the details of the business transfer and terms in the contract.

- Non-Competition: A non-competition clause means the seller promises to not compete with the business by starting a new business in the same market.

- Non-Solicitation: Non-solicitation prevents employee poaching, meaning the seller will not hire any of their former employees away from the business.

These documents must be executed to the letter, or there can be severe ramifications down the road if disputes over ownership arise. It is also imperative that the contracts are completely factual. Illegitimate statements can void the contract, transferring ownership back to the original seller.

Conclusion

Business purchase agreements occur every day in the US, but that doesn’t mean you should be careless when drafting and singing them. Make sure you consider all aspects of the business and if you take anything away from this guide, let it be that you should involve an attorney.

Whether you have a relationship with or trust the other party, having an accountant and attorney facilitate the contract can save both parties from problems and disputes later on.

Common Related Questions

Business purchase agreements can be new territory for many. Below are common questions that both sellers and buyers ask when dealing with them.