Real Estate Purchase Agreement

A Real Estate Real Estate Purchase Agreement governs the sale of a property. It is an agreement between two parties to transfer the ownership of real property based on an agreed-to price, plus other conditions of sale. When you see “under contract” or “sale pending,” chances are a Real Estate Purchase Agreement is in place covering the sale of that property.

Other names for a Purchase Agreement for land or property include, but are not limited to:

- Real Estate Sales Contract

- Home Purchase and Sale Agreement

- Real Estate Purchase Contract

- House Purchase Agreement

- Property Purchase Contract

- Property Asset Purchase Agreement

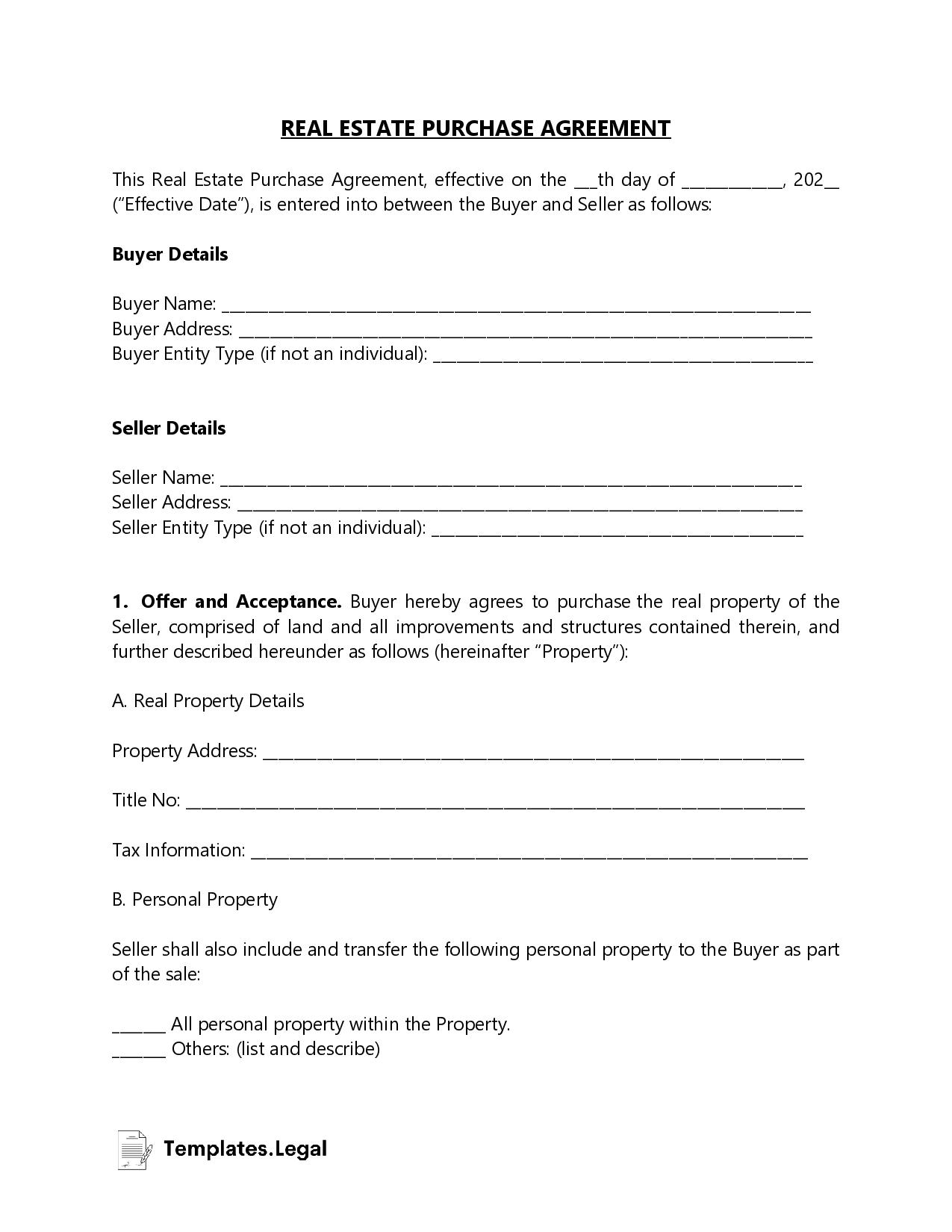

Real Estate Purchase Agreement Template

Real Estate Purchase Agreement By State

In the Real Estate Purchase Agreement, data covers every aspect of the property and sale, including indirect requirements, stipulations, or clauses. Data also includes stipulations that affect the legitimacy of the sale and how it proceeds through the real estate transfer process.

For example, a Land Purchase Agreement may only be valid if the owner makes improvements or repairs to a building or property. The Real Estate Purchase Contract will also cover applicable Rights of Way, water, and mineral rights.

Additionally, the Purchase Agreement will include purchase and payment terms, including those that negate the sale.

The Real Estate Purchase Agreement is legally binding unless both parties agree to make a change.

How it Differs From Other Agreements

The core difference between a Purchase Agreement and other agreements is the precise nature of the contract. It covers the transfer of ownership of the property, including agreed-to price, payment details and schedules, stipulations, requirements, and terms for paying third parties.

Other types of purchase agreements tend to be more general. A Real Estate Purchase Agreement, for example, will cover things like the use of intellectual property and trademarks, payment for that use, non-compete terms, etc.

A Real Estate Purchase Agreement covers the sale of land or a structure to facilitate the sale, not govern aspects of the use of the property, etc.

What Does A Real Estate Purchase Agreement Entail?

At a minimum, a Real Estate Purchase Agreement will include:

- Buyer and Seller Information. Buyer and Seller Information includes the full names and contact information of the buyer and seller.

- Property Description. Property Description covers the property for sale and any pertinent details that apply to that property.

- Purchase Price. Purchase Price is the agreed-to price between the buyer and seller, including how taxes and fees are covered.

- Closing Date. The Closing Date is when the land transfer is effective and when payments are due.

- Confidentiality. Confidentiality covers all aspects of the Purchase Agreement that are not subject to public disclosure. Information covered by a confidentiality clause can include the sale, provided all parties meet disclosure requirements.

- Representations and Warranties. Representations and Warranties cover facts about the property condition, structure, and composition. “As-is,” for example, means the property is purchased regardless of its state. Representations and Warranties information is also covered in a Warranty Deed in some cases.

- Financing. Financing in a real estate contract covers how the buyer will purchase the property. It outlines any borrowing or mortgaging details, whether the buyer is assuming any existing mortgages, and the payment method (cash, check, cashier’s check, etc.)

- Fixtures and Appliances. Fixtures are wall-mounted parts of the property that the seller will not remove. In some Purchase Agreements, items the seller can remove are included in a list. Appliances are the equipment the seller will be leaving as part of the sale (dishwashers, stove, refrigerator, etc.)

- Title Insurance. A title insurance section in a contract stipulates whether the buyer or seller will be purchasing title insurance against any discoverable defects in the property.

- Taxes. Taxes get covered in this section, including property and transfer fees and taxes. Often, payment of property taxes happens upon the sale of the property.

- Good Faith Stipulations. Good faith clauses in a Real Estate Purchase Agreement cover any security deposits or other requirements to show the buyer is interested and committed to the sale. Good faith clauses cover the period between the start date of the agreement and the closing date. This section can also include an Option to Terminate clause.

- Conditions of Sale. Conditions mean anything that the sale and transfer of ownership are contingent upon, including that the finances are in order, the property adheres to municipal requirements, lead-paint disclosures, environmental remediation or mitigation, etc. A condition of sale also includes stipulations about outstanding debt or the transfer of existing rights, contracts, etc. If the seller fails to meet a condition, the buyer can opt out, renegotiate the price, or insist that additional terms or conditions be applied. The Conditions section also covers mediation and processes for any disputed issues.

Why It Matters

A Real Estate Purchase Agreement exists to make a property sale proceed as smoothly as possible. The Purchase Agreement documents:

- Terms of the sale

- Price

- Expectations

The Real Estate Sale Contract is a contractual commitment from both parties regarding the purchase and the terms of the sale.

Specifically, the Real Estate Purchase Agreement helps establish the following:

- The ownership transfer process and what constitutes the sale

- Property boundaries

- That all financial aspects of the sale are in order, and effective

- That payment is remitted in an orderly fashion

- Ownership rights to the property and any buildings

- Ownership to any extraneous property characteristics, in actuality or to be discovered (water and mineral rights)

- The disposition of applicable outstanding contracts, rental agreements, and rights of way

- Insurance requirements to protect the buyer and seller

- Taxes and fees as well as who pays what

- Stipulations for sale include a method for handling disputes

How To Set Up a Real Estate Purchase Agreement

The most sensible approach to setting up a Real Estate Purchase Agreement is to have your real estate agent draw one up, seek legal counsel, or use an online Real Estate Purchase Agreement template. Not using professional services to draft the Purchase Agreement may render it, or parts of it, null and void, particularly if it violates any laws.

Whether you use a professional or a free Real Estate Purchase Contract template, the following is the process.

Pertinent Contact Information Collection

Pertinent contact information is any information that defines the property address, buyer, seller, real estate or legal representation, banking, and financial institutions.

Property Description

Property Description covers:

- Physical description of the property

- Definition of property lines

- Property characteristics

- State of the property

- Property liabilities

Sales Price

The sales price includes the final price the buyer and seller agree to, excluding any alterations to the property that is a stipulation of the sale. It also includes taxes and fees and which party will assume paying them. If the contract stipulates the buyer will pay taxes and fees, including outstanding taxes, that figure gets factored into the sale total.

Payment Terms

The sale of the property is usually contingent on financing. Payment terms, especially if the sale is owner-financed, get spelled out here. Those include:

- Payment amount

- Payment frequency

- Lender

- Address of seller

If financing falls through, the sale and the Real Estate Purchase Agreement are voided. Depending on the type of sale, there may be legal requirements, including paying the seller for any time invested in the financing process.

Terms of Sale

The Terms of Sale section outlines what is being purchased, any conditions on the sale of the property, all buyer and seller rights received or maintained, transfer of ownership conditions, including any financial arrangements.

This section also covers any stipulations that validate or obviate the sale. It maps out any mediation processes should a disagreement arise. Those terms could include:

- Buyer and Seller representations and warranties

- Conditions present: A condition that must be met for the sale to be valid and any conditions that predate the sale or are maintained by the owner (mineral and water rights as well as the right of way definitions)

Signatures

The signatures section includes:

- Buyer and seller signatures

- Witnesses

- Legal and financial representatives