Alaska Promissory Note Templates

An Alaska promissory note is an agreement between a lender and a borrower. The promissory note template includes information about the type of loan, due dates for payments, collateral for the loan (if used), the interest rate, and other terms and details.

The lender and borrower need to agree to the terms of the loan. They can then use a free Alaska promissory note template to make the agreement legally binding.

When making an Alaska promissory note, you need to be aware of the relevant laws and rules. For example, in Alaska, usury laws prohibit an interest rate of more than 10.5%. However, this limit does not apply to loans with a principle of more than $25,000.

You also need to select the correct Alaska promissory note template. There are two options: a promissory note for a secured loan and a note for an unsecured loan.

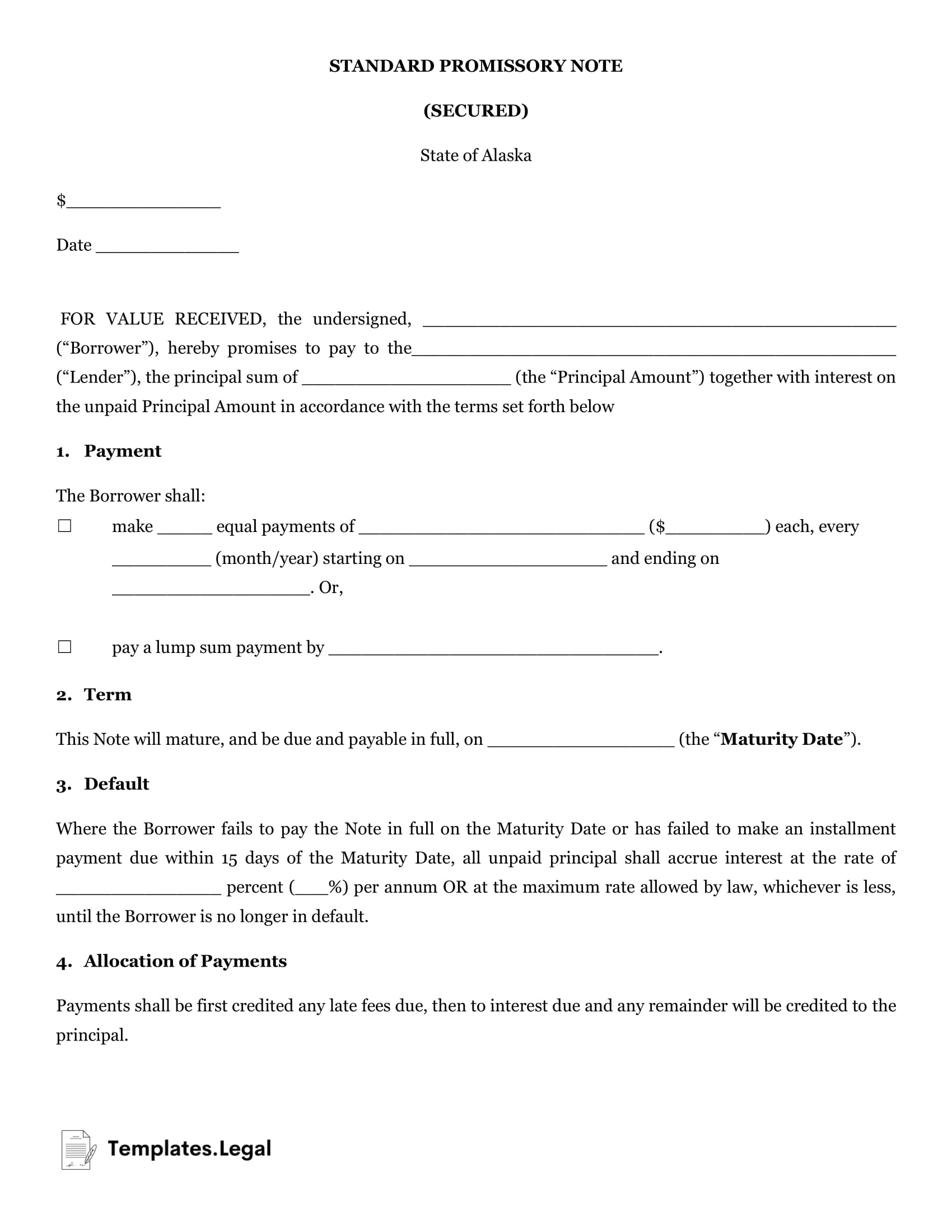

Alaska Secured Promissory Note

An Alaska promissory note is a secured promissory note if the agreement involves using property or assets as collateral for the loan.

The details of a secured promissory note stipulate that the lender can take control of an asset that the borrower puts up as collateral if the borrower does not repay the loan according to all the deadlines and requirements listed in the promissory note.

A promissory note Alaska form will define the assets that the borrower uses to secure the loan. It will also set out the terms for repayment, due dates, and the conditions that the borrower needs to meet to avoid having their property repossessed.

All requirements, such as interest payments, due dates, and payment amounts, are also listed in the promissory note.

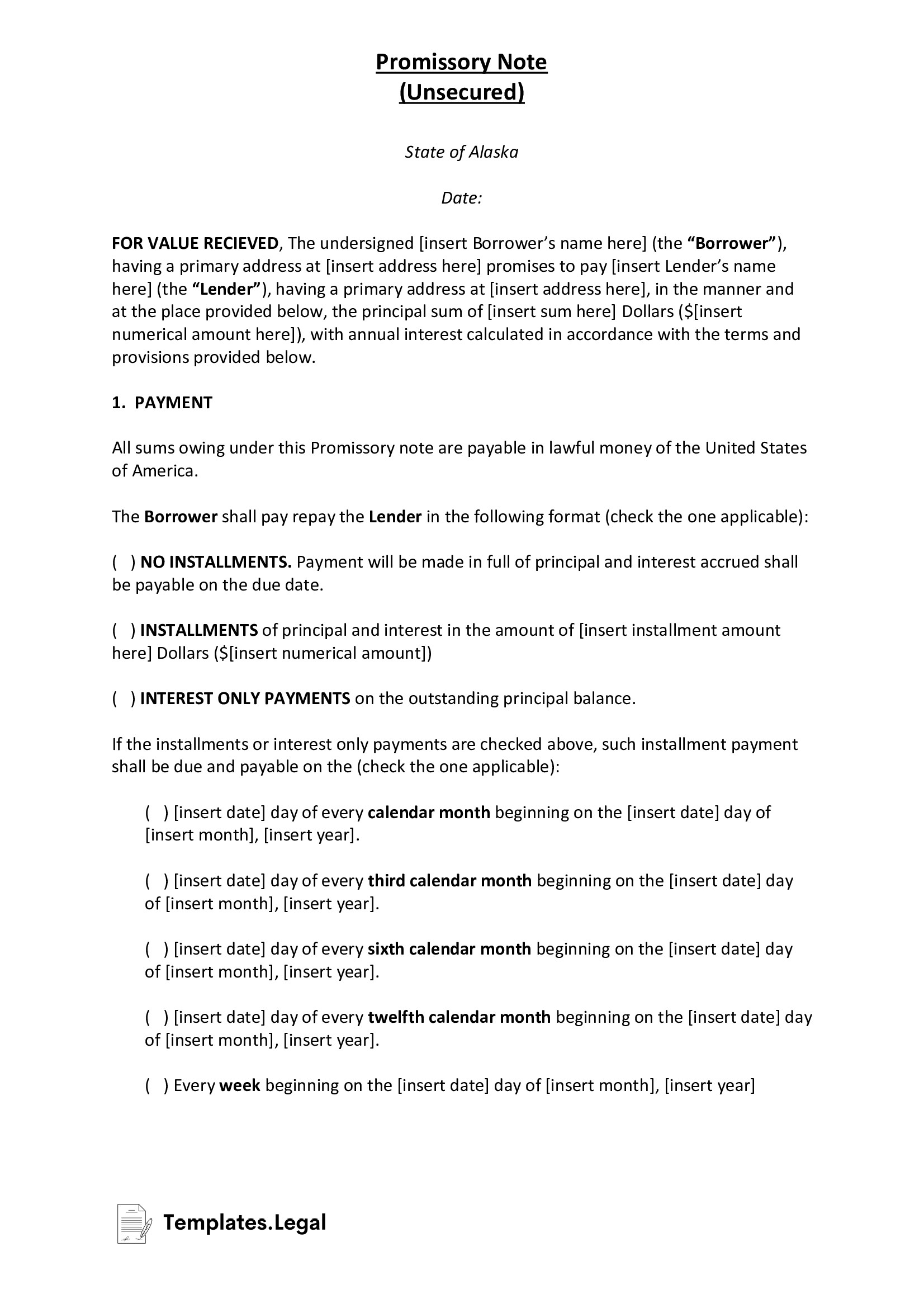

Alaska Unsecured Promissory Note

An unsecured Alaska promissory note is very similar to a secured promissory note, with one vital difference: it does not include information about property used as collateral. Unsecured promissory notes are still legally binding, but they do not require assets to secure the loan.

When you fill out a free Alaska promissory note form, you identify the lender, the borrower, and the amount of the loan. The document will also include repayment details, such as due dates and installment amounts.

There is no information about collateral in an unsecured Alaska promissory note. However, there is information about steps the lender can take if the borrower does not meet the terms of the agreement.

For example, a lender can take the borrower to a small claims court to get a court order that requires repayment.

Frequently Asked Questions

You can get a free Alaska promissory note template to help with the process, but you should still understand the rules related to promissory notes in Alaska.