Arizona Promissory Note Templates

An Arizona promissory note is a written document that preserves the details of a loan made from one party to another. In other words, it is a contract between a lender and a borrower.

The promissory note should include details of the loan, such as interest rates, payment plans, and due dates. It must also include each party’s personal information (names and addresses). Because it is a contract, it is subject to contract law and usury laws in Arizona. It may also be subject to securities law, depending on what the loan involves.

There are two types of Arizona promissory notes: secured and unsecured.

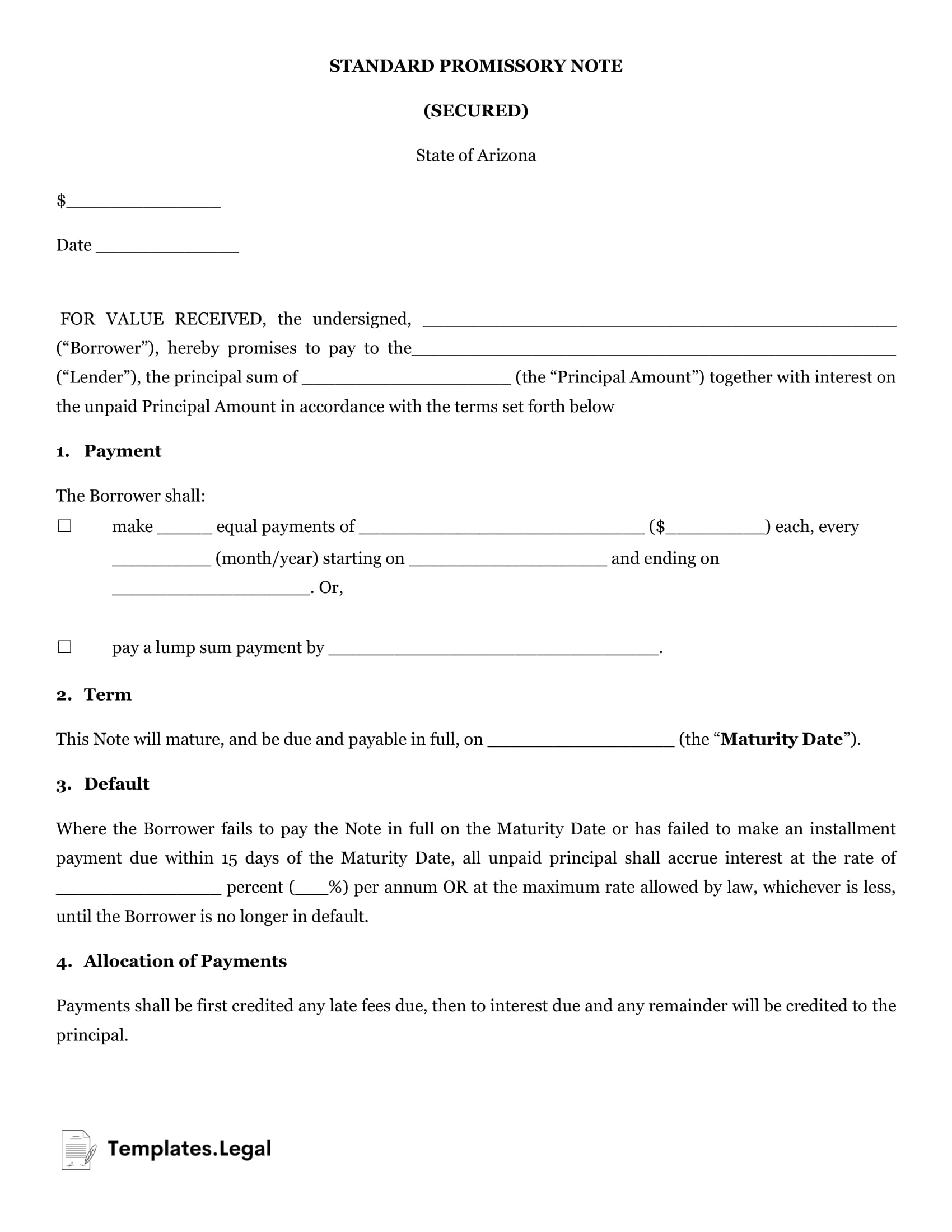

Arizona Secured Promissory Note

A secured promissory note is the loan type that offers the most guarantees for a lender.

To enter into a secured loan, the borrower must offer collateral, which the lender can legally take possession of in the event of nonpayment. Some common forms of insurance include homes, cars, boats, and other items of value.

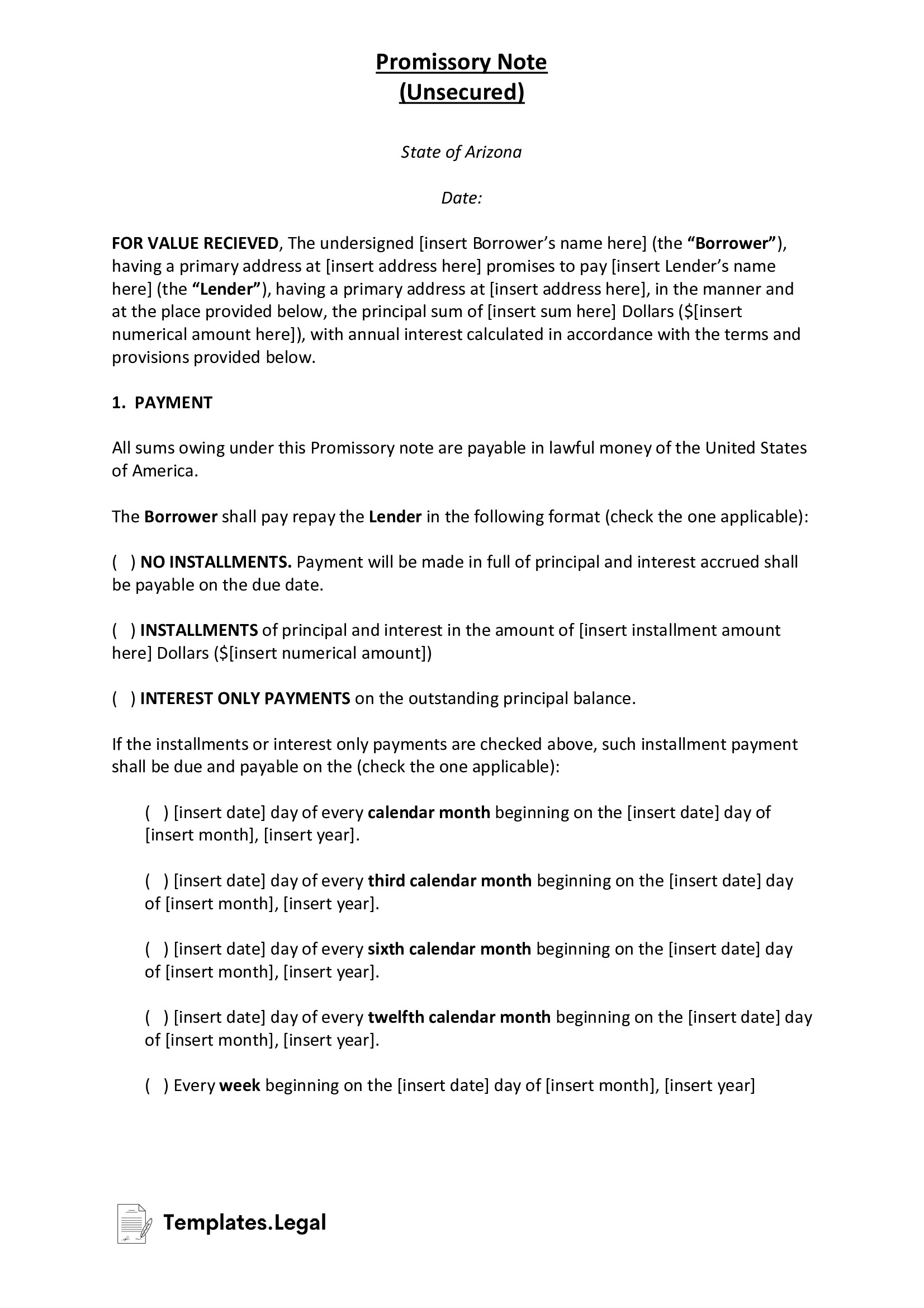

Arizona Unsecured Promissory Note

An unsecured promissory note provides fewer guarantees for the lender, as this type of loan does not require the borrower to offer up collateral in the event of nonpayment. Should the borrower default on the amount owed, the lender has no guarantee of recovering the money lost.

There usually exists a high level of trust between parties who sign an unsecured promissory note, such as that between families or close friends. Individuals considered “reliable” (those with excellent credit or high net worth, for example) might also sign unsecured promissory notes.