Arkansas Promissory Note Templates

An Arkansas promissory note is a legally binding contract between two parties, a lender and a borrower.

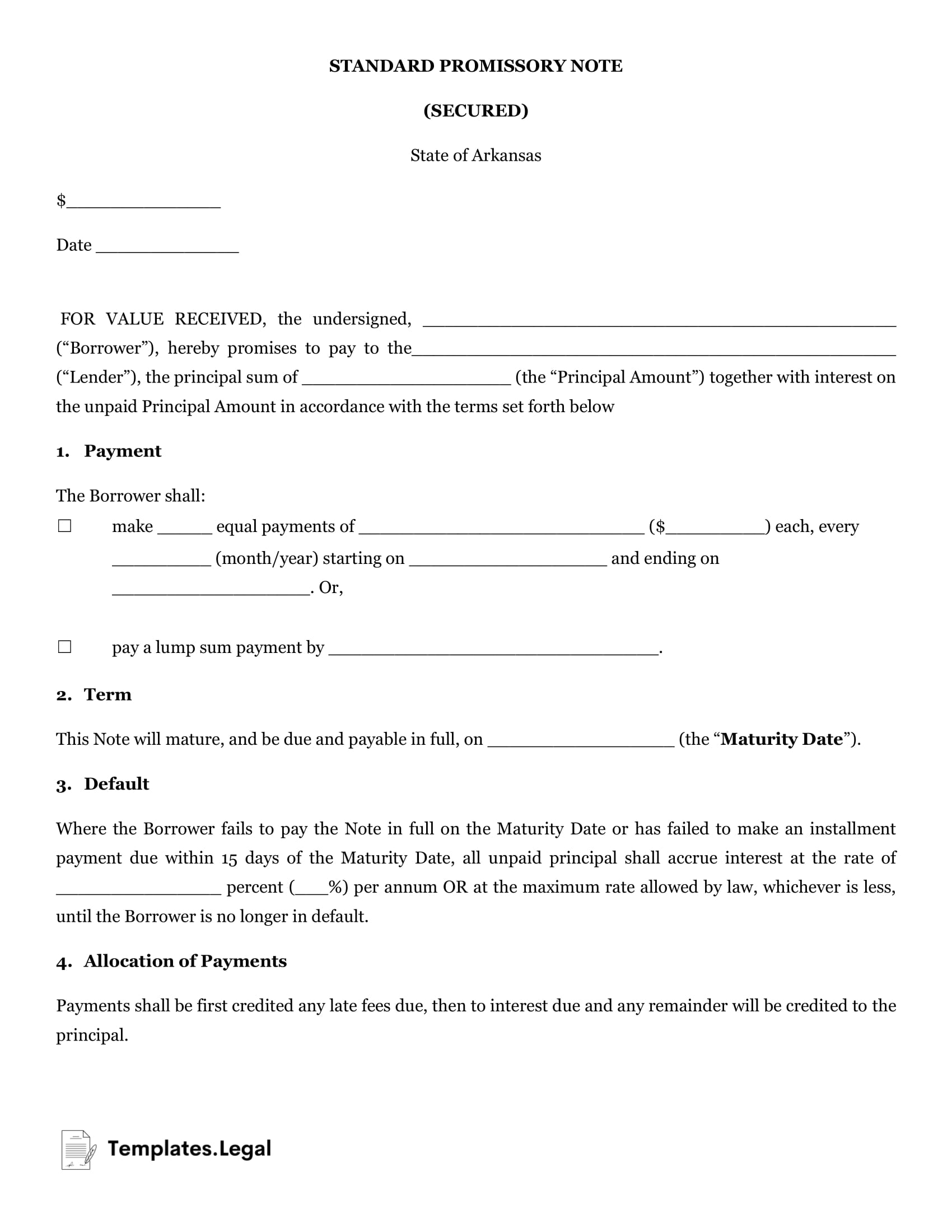

Its purpose is to outline the details of a loan and act as proof of the existence of that loan. A promissory note typically includes information about pertinent loan details, such as interest rates, payment dates, and how payments will be made. They should also include clauses that further define the loan, such as attorney fees, severability, and prepayment.

Promissory notes must comply with Arkansas law to be considered valid. Arkansas Code Title 4 regulates promissory notes related to business or commercial law, for example. Promissory notes related to higher education fall under Arkansas Code Title 6.

There are two types of Arkansas promissory notes: secured and unsecured.

Arkansas Secured Promissory Note

To enter into a secured loan, the borrower must provide some form of collateral. Common types of collateral include cars, homes, or other items of value. In the event of nonpayment, the lender can legally take possession of the agreed-upon collateral to recover the loan’s cost.

Most financial institutions require secured loans unless the borrower has outstanding credit or high net worth.

Once the loan is repaid in full, the lender must provide the borrower with a written statement relieving them of any further payment obligations.

Arkansas Unsecured Promissory Note

An unsecured promissory note has no form of collateral backing it, which makes it a more risky loan for a lender. As such, it’s more common among family members and close friends.

Should the borrower default on their payments, the lender must resort to taking the borrower to small claims court (if the total amount remaining is less than $10,000). They can also report the nonpayment to a credit agency.