Idaho Promissory Note Templates

An Idaho promissory note is a written agreement between a lender and borrower. When a borrower signs a promissory note, he or she agrees and promises to repay a loan. The agreement outlines the terms of the loan, which include the amount of the loan and the period of time in which the loan should be paid in full. There are two types of promissory notes in Idaho: secured and unsecured.

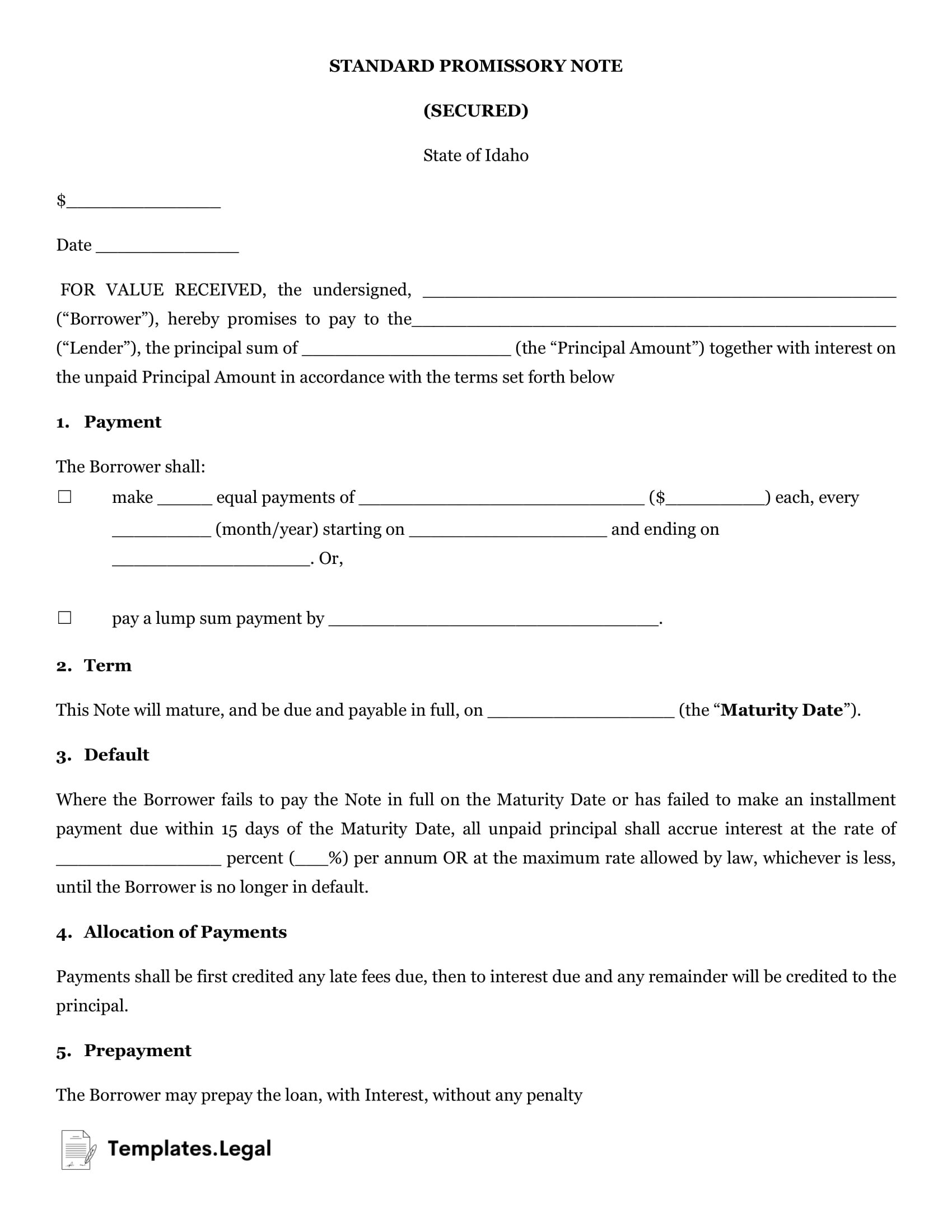

Idaho Secured Promissory Note

A secured promissory note grants the lender the right to collect property. Therefore, if the borrower defaults on the loan or stops making payments on it, the lender will be reimbursed.

Idaho Unsecured Promissory Note

An unsecured promissory note doesn’t include security, which adds greater risk to the lender when completing the transaction. This means that the lender doesn’t have the right to collect collateral if the borrower defaults.

If a lender decides to issue an unsecured promissory note, he or she should ensure the borrower is a trustworthy individual. Fortunately, creating a promissory note Idaho form is simple. You can make a free Idaho promissory note on your own.

For most transactions, a promissory note template for Idaho should be sufficient.