Indiana Promissory Note Templates

An Indiana promissory note is a written promise to pay a sum of money to a lender at a particular time in the future. The borrower, lender, and sometimes a co-signer are involved in the signing of a promissory note. A promissory note in Indiana can be secured or unsecured.

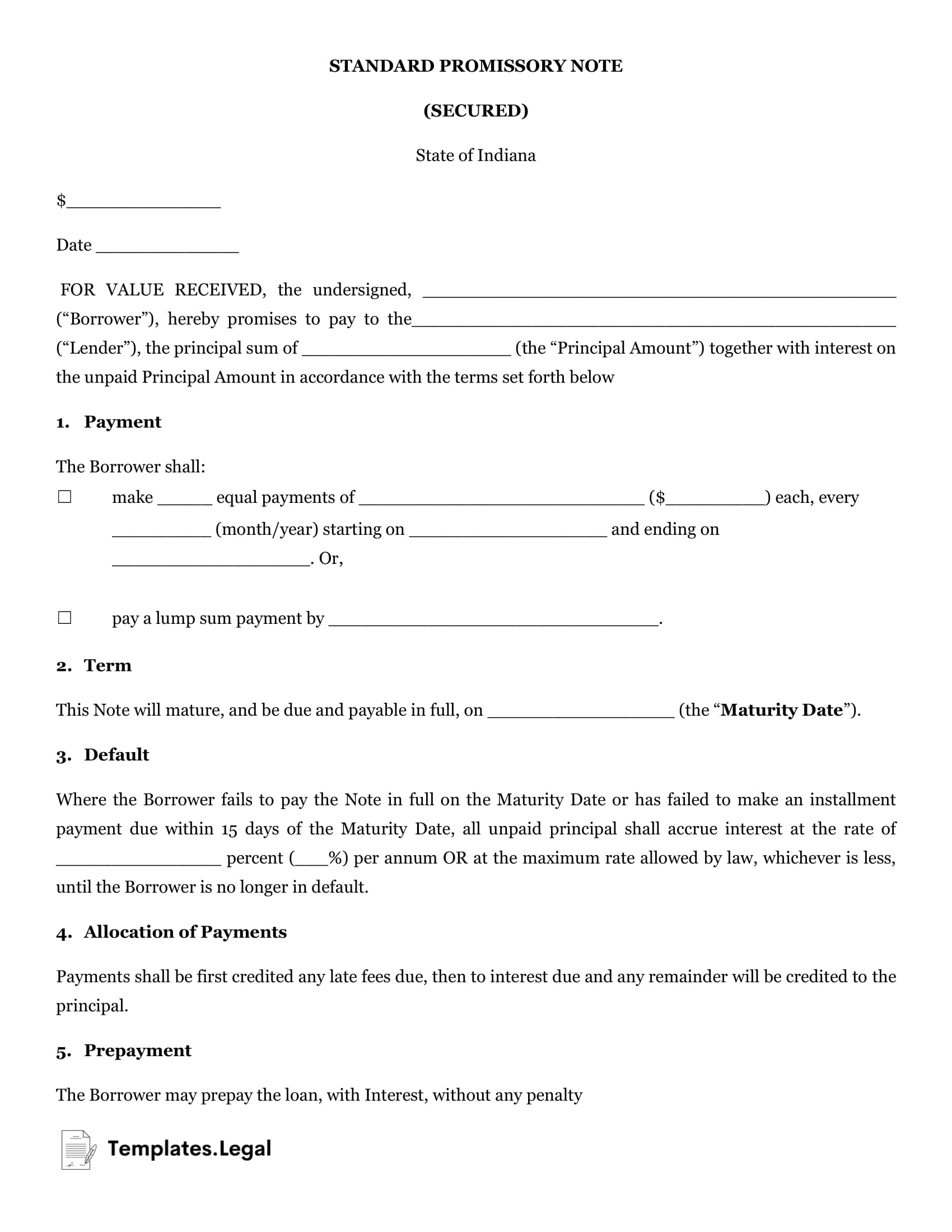

Indiana Secured Promissory Note

When a borrower signs a secured promissory note, they agree to relinquish their property in the event they default on the loan. Therefore, if the borrower fails to pay, the lender can seize the property to obtain reimbursement for the loan. The property or collateral that secures the note can be either real estate or personal property. A promissory note Indiana form is a commonly available document and is simple to fill out.

Indiana Unsecured Promissory Note

An unsecured promissory note doesn’t include any property securing the payment. Therefore, it can be more difficult to enforce an unsecured promissory note. If a borrower fails to pay back the loan, the lender can file a lawsuit and hope that the borrower has assets that can be seized to satisfy the loan.

You can use an unsecured promissory note template for Indiana and fill in the details yourself. A free Indiana promissory note is all that’s necessary to record the transaction.