Iowa Promissory Note Templates

An Iowa promissory note is a legally binding document that says the borrower promises to repay a lender a certain amount of money within a given period of time. The promissory note details terms of a loan, such as interest, fees, and the amount of the loan. In Iowa, a promissory note can be either secured or unsecured.

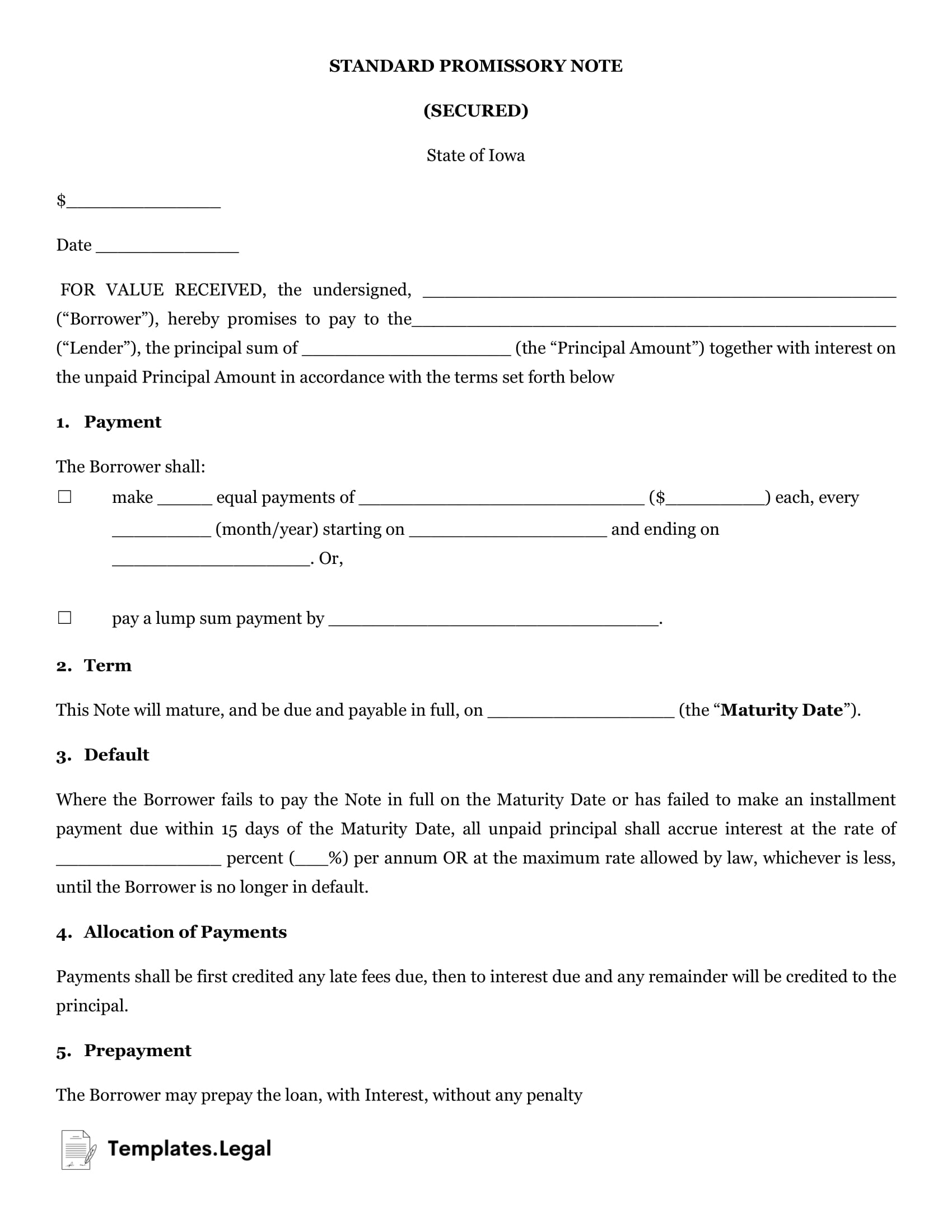

Iowa Secured Promissory Note

When a borrower signs a secured promissory note, they agree to relinquish any property or asset to the lender if they fail to repay the loan. Thus, the lender will stand to gain something if the borrower defaults on the loan.

An example of a secured promissory note is financing a car. If a borrower does not pay, the lender can repossess the vehicle.

Iowa Unsecured Promissory Note

It can be more challenging to collect from an unsecured promissory note. This is because unsecured promissory notes offer no protection to the lender for an unpaid debt.

However, you can find an unsecured promissory note template for Iowa and fill it in yourself. Free Iowa promissory notes are available online, and the promissory note template in Iowa is straightforward.