New Jersey Promissory Note Templates

Promissory notes define the parameters of a loan between a borrower and a lender. These types of notes are more formal than an IOU but require less legal know-how compared to a loan agreement. Both the borrower and the lender can find an easy-to-access, free New Jersey promissory note online.

Like a regular loan, the principal amount (value of the loan) can accrue interest to urge the borrower to repay faster. In New Jersey, the maximum interest rate is 16%, according to the New Jersey Statutes Annotated § 31:1-1.

Secured and unsecured comprise the two types of promissory notes found in New Jersey.

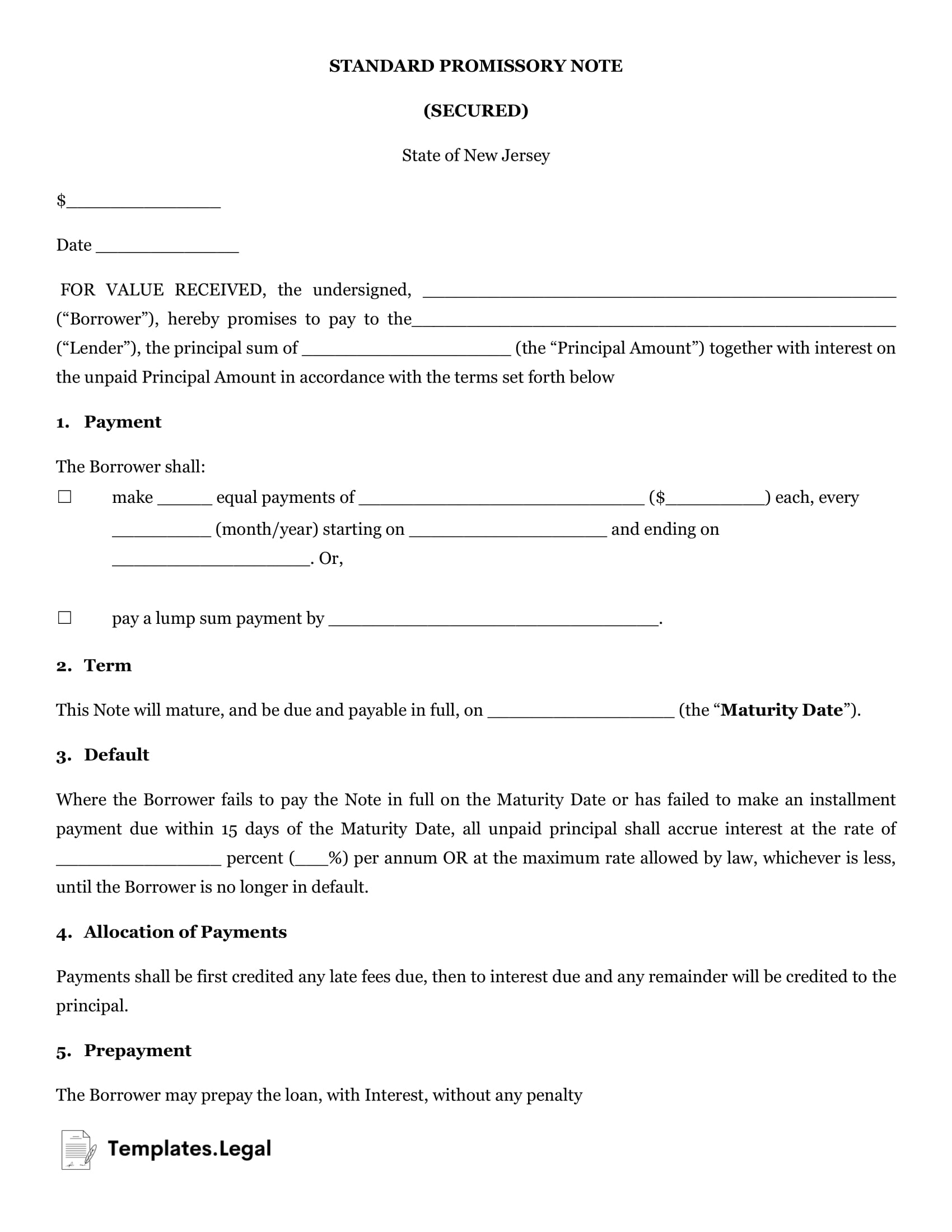

New Jersey Secured Promissory Note

Secured promissory notes require the borrower to offer an asset equal to the principal amount should they default on the loan. The asset could be a boat, vehicle, property, or anything of value. Since the loan is secured, the lender knows they’ll make back their money in some way.

A promissory note template New Jersey is usually only a couple pages long and doesn’t use legal jargon. Therefore, all parties involved can easily understand the stipulations of the note without the assistance of a lawyer before signing.

To fill out a New Jersey promissory note, you will need the following information:

- Borrower’s full name and address

- Lender’s full name and address

- Principal amount, or the amount of the loan

- Interest rate, if relevant

- How many days may pass before the lender issues a lay

- Principal amount payment deadline

- Signatures of borrower, lender, and a notary public

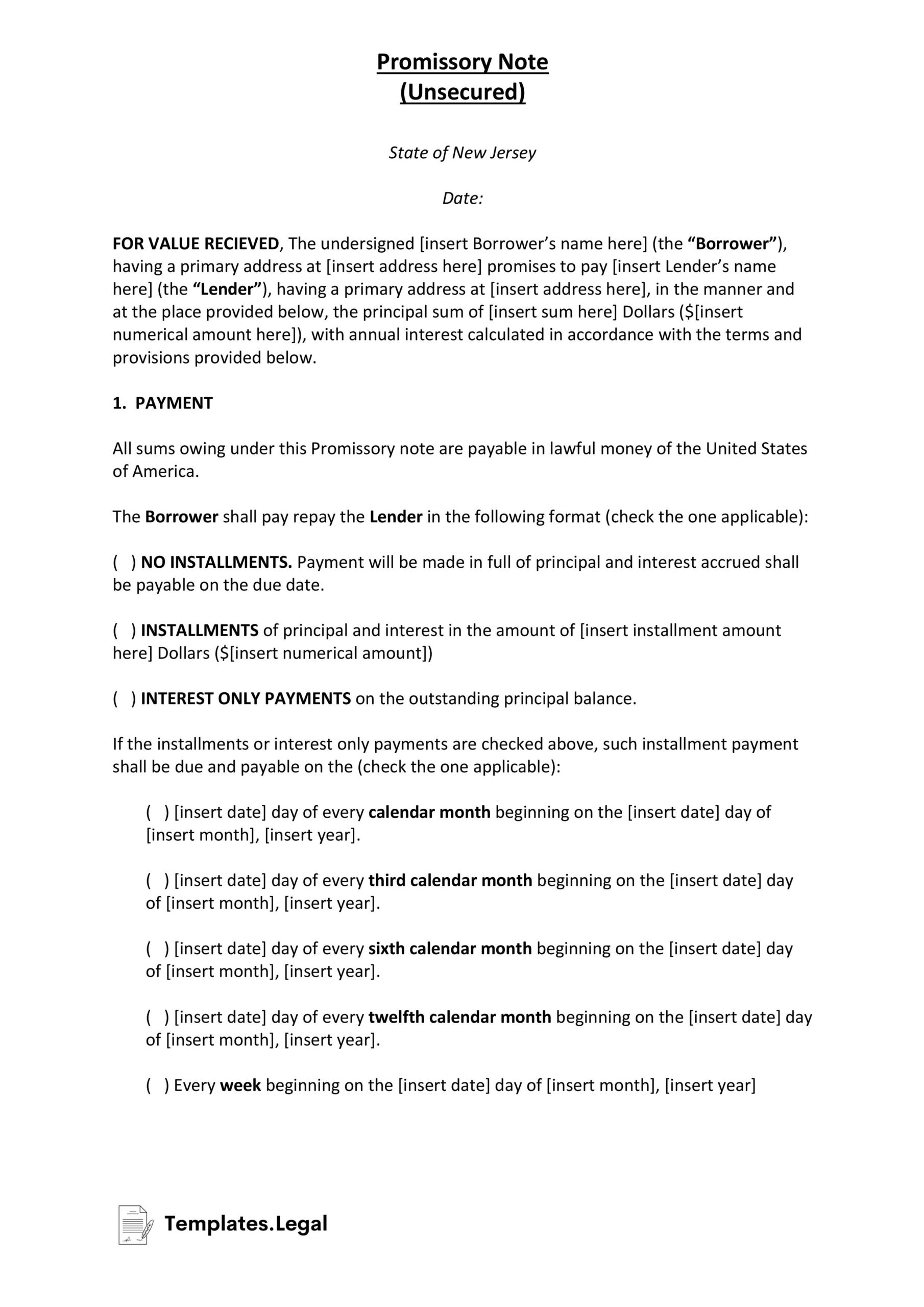

New Jersey Unsecured Promissory Note

A promissory note New Jersey form will require almost all of the same information as a secured promissory note. The only difference between an unsecured and secured promissory note is the collateral. An unsecured promissory note does not require the borrower to offer an asset should they default on the loan, making this transaction riskier for the lender.

Unsecured New Jersey promissory notes are common between parties in a trusting relationship, such as friends or family members. Social capital is at stake rather than a valuable asset.

Even though this note is unsecured, the lender still has ways to make the borrower repay the loan. Since all promissory notes are legally binding in the United States, a lender can take the document to court and the borrower to pay back the loan faster.