New York Promissory Note Templates

A promissory note is a legally-binding formal loan agreement without all the legal jargon. This note stipulates who the parties are, how much money exchanged hands, and when the borrower must repay the lender.

It’s easy to find a free New York promissory note contract online to record a transaction between a borrower and a lender. In New York, the maximum interest rate for a promissory note is 16%, according to the state’s General Obligations Law § 5-501(1).

The Empire State has two forms of promissory notes: secured and unsecured.

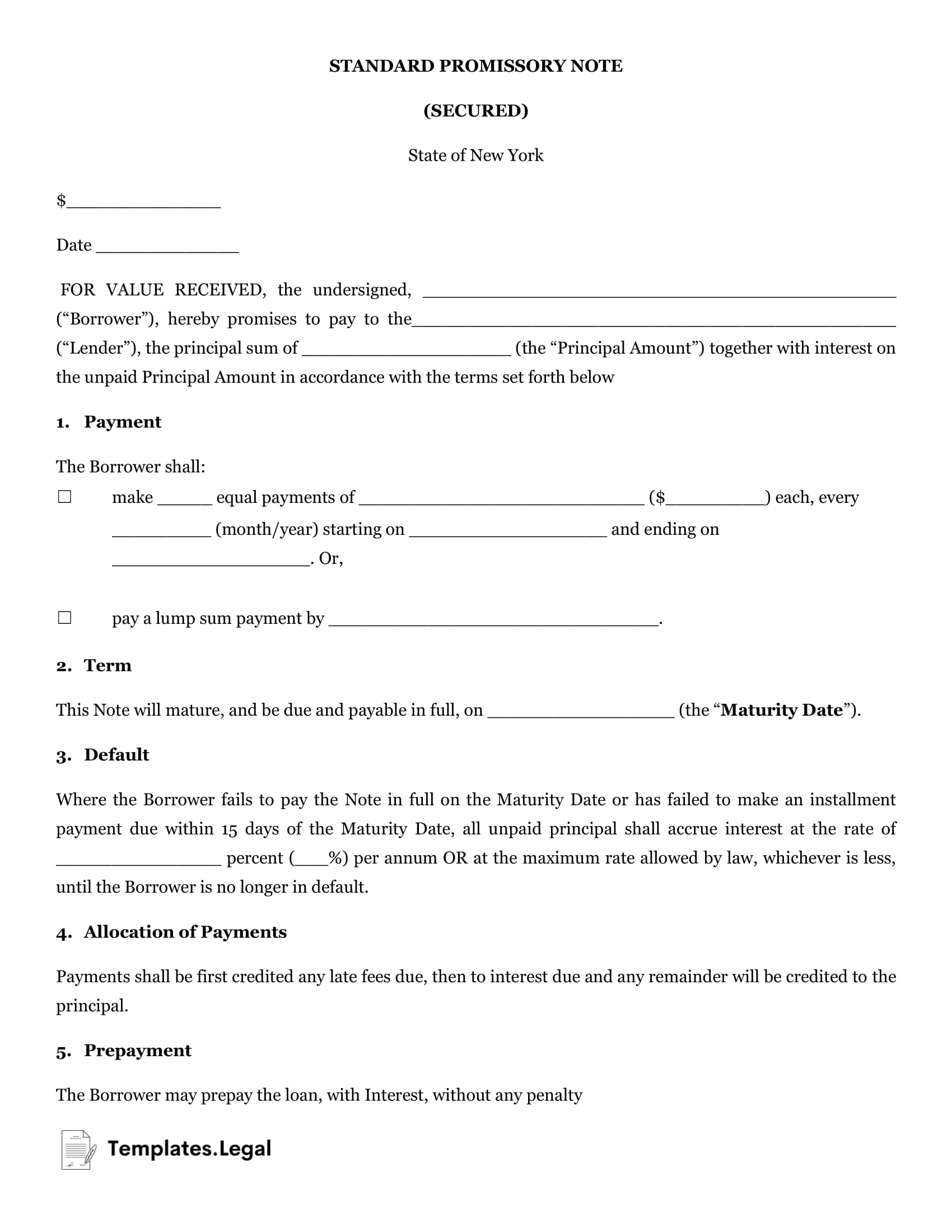

New York Secured Promissory Note

The borrower must offer some sort of collateral to back up a secured promissory note. The collateral ensures that the lender’s investment is protected, as the lender will, through the asset, receive reimbursement.

Because of their security, secured promissory notes are a common document between people without established social connections, such as an investor and a start-up. The lender only needs to worry about when they’ll get repaid rather than if they’ll get repaid at all.

A promissory note template New York will require the following information:

- Day, month, and year of the transaction

- The borrower’s full name

- The borrower’s address

- The lender’s full name

- The lender’s address

- Loan amount

- Interest rate

- How the borrower will pay the principal back

- Information on how the lender will issue late fees

- Deadline for repaying the loan in full

- Collateral assets

- Signatures of the borrower, lender, and perhaps a notary public

New York Unsecured Promissory Note

As the name suggests, unsecured promissory notes do not have collateral to secure the loan. Unsecured promissory notes are thus a riskier investment for the lender.

As a result, unsecured promissory notes are more common between parties that have worked with each other in the past and established a relationship. Friends and family members may also use unsecured promissory notes, as social capital will be the collateral instead of a monetarily valuable asset.

A promissory note New York will require almost all of the same information as the secured promissory note New York form. The only difference, of course, is the collateral asset stipulation.