General Warranty Deed Templates

A deed is a legal document that transfers the ownership title of a property between people. When someone is selling their property, they and the buyer sign a document that guarantees the legal transfer of property ownership. You also have to file this document with the local government office.

Deed forms come in a few different varieties—the main types being a deed of trust, general warranty deed, quitclaim deed, and special warranty deed. And while these different forms overlap on many features, they also have their nuances. This article will discuss the general warranty deed form and how it differs from the other types.

General Warranty Deed By State

What Is a General Warranty Deed?

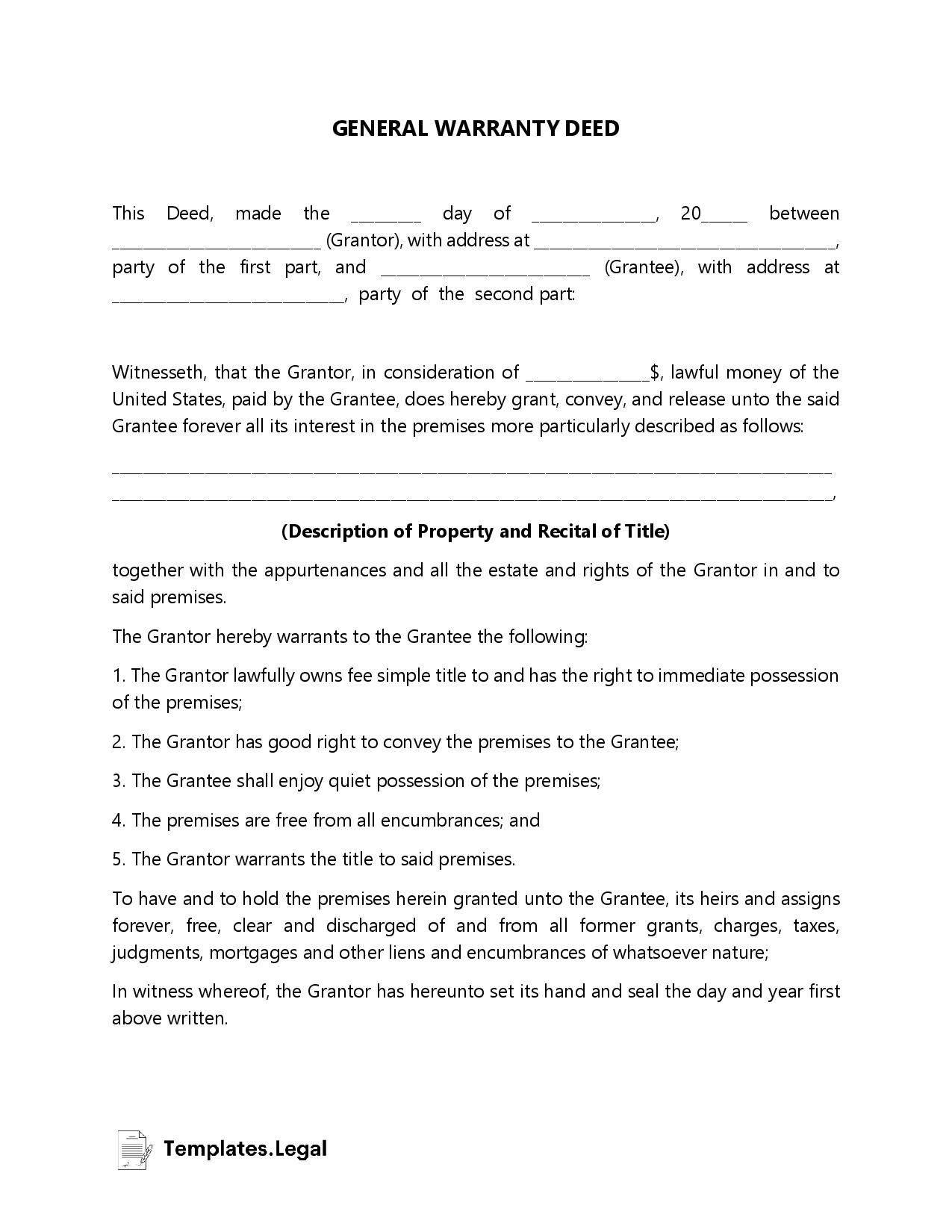

The general warranty deed form is the document that legally transfers the property ownership from seller to buyer. In addition to transferring the title, this deed also makes certain guarantees to the buyer to protect them from liens or claims against the property. It helps the buyer avoid purchasing a property only to be stuck in legal problems with other parties.

In the language of property deeds, the seller is often called the grantor because they are granting certain covenants (promises) to the buyer. And the buyer is called the grantee because they are the persons to whom the covenants are being made.

So the general warranty deed template protects the buyer by making a series of legal promises to the buyer as part of the title transfer. Should any of these promises be broken or turn out to be false, the buyer can then take legal action against the seller. The promises are:

- The seller has the title and currently possesses the property.

- The seller guarantees that there are no limitations or encumbrances against the title.

- The buyer (grantee) does not have to defend the property against future claims.

- The buyer will have unrestricted use and enjoyment of the property.

- The seller will correct any problems with a defective deed.

As you can see, this deed offers extensive protection to the buyer. To view a general warranty deed example in its more specific and legal language, you can check out this example from the University of Maine.

How Does It Differ From Other Deed Types?

To get a better idea of how a general warranty deed form works, it is helpful to compare it to the other types.

A special warranty deed only guarantees that there were no claims against the property during the time that the seller owned the property. Compared with the special warranty deed, the general warranty deed is safer for the buyer because it comes with more protection–special warranty deeds don’t cover the time during which previous owners had the property.

A general warranty deed differs even more from a quitclaim deed, which offers little to no protection for the buyer. The quitclaim deed form does not involve any promises between the seller and the buyer, and it does not allow the buyer to take legal action against the seller. It is often used when transferring property between family members.

And finally, a deed of trust is essentially the deed that certain states use in place of a mortgage. In this form, the buyer borrows money from a lender to buy the property but signs the property over to a third-party trustee. Or the third party can hold a lien against the property which gives them a claim to it until the borrowed money is paid off.

So in terms of a comparison of the different deed types, the general warranty deed is best for the buyer. This free general warranty deed put out as a sample from Monroe County gives an example of the language used in Florida. As you can see, it offers comprehensive protection against liens, claims, or encumbrances that might arise against the property.

Obtaining a General Warranty Deed: A Step-by-Step Guide

To create the general warranty deed, there are a few things you should have ready to go. You should know what sections that the document contains and be ready to fill them out. And you should also know where to obtain the document and how to file it with your local government office.

So let’s go through a few of the main steps for successfully obtaining this deed.

Gather Information

Before filling out your deed, be sure that you have the required information handy and that it is accurate. Legal documents and legal language can be confusing, so you should also consider using a lawyer so that you know exactly what you are singing.

Whether or not you use a lawyer, you will need the following information to fill out the deed:

- Name and address of the grantor (seller)

- Name and address of the grantee (buyer)

- A description of the property in legal terms

- Signatures of buyer and seller, as well as a notary

That is the basic personal information you will need, but depending on your state’s requirements, there might be more information needed.

Obtain Form

Assuming you have the information of the people and property ready to go, you now need to find the specific form that is required for your state. Every state has its form, and the language required in each state is slightly different. Again, this is why it is a smart idea to have the help of a lawyer.

Once you know the specific requirements for your state, you can draft a deed document that includes those, along with the already mentioned legal description of the property. New York State, for example, calls their warranty deeds a “deed with full covenants”, and requires specific language. There are also online templates that will help you to get started with drafting your deed.

And if you are going through a real estate office, they should be able to guide you with drafting the document. It’s important to note, though, that most government offices will not help you draft the document because technically that would be considered legal advice. Another important thing to note is that the document must be an original copy. Make sure you are not trying to file a deed with a photocopy.

Sign And File

Once you’ve drafted the legal deed, added your personal information, and written in an adequate legal description of the property, it is time to sign and file your deed. Both parties must sign the document in front of a notary who must also sign it. Failure to do this correctly could void the legitimacy of your deed.

And then, whether or not you are using realtors and lawyers, you must file that deed with your local county clerk’s office. There are specific rules for how to do this, and there are usually other tax forms required in addition to the deed. There are also fees associated with filing a deed. Here is an example of the legal requirements in New York State for filing a general warranty deed.

General Warranty Deed: FAQs

Hopefully, you now have a good general idea about how the general warranty deed works, how to obtain and file it, and why it offers such good protection for a buyer. But let’s give a summary of this deed by answering some of the most common questions.