Quitclaim Deed Templates

A quitclaim deed is one of the most accessible forms to transfer real estate from one owner to another. This process is more straightforward because there’s no requirement for a title search and title insurance. Quitclaim deeds are commonly used between parties who are close relatives or spouses.

Many people refer to this form as a “quick” claim deed because it’s also the fastest way to transfer property between parties. Most states recognize this type of property deed as a way to change property titles or ownership rights to land without running a search for insurance, liens, and other claims to the real estate.

Quitclaim Deed By State

How Property Owners Use Quitclaim Deeds

Quitclaim deeds are commonly used to transfer property. At the same time, this form is often used to transfer land or real estate between family members or spouses. A quitclaim deed is also used to remove a name or persons from a property title. This type of deed is ideal when the property transfers to another party and one or more individuals need to be removed from the title.

Adding Parties to a Property Deed

A quitclaim deed is an easy way to add a new spouse to a title following a marriage. It’s also ideal for adding relative or new parties to claim ownership. If there is joint ownership of the property, such as between spouses or family members, quitclaim deeds can be used to transfer the property to other relatives, including children. You can also use this type of deed to transfer property interest to a limited liability corporation or business partner.

Removing Family Members and Ex-Spouses from Property Deeds

There is a degree of flexibility for grantors to remove an ex-spouse or family member. This process is most common in the event of a divorce or to prevent a family member from claiming ownership of real estate or land in the future.

An ex-spouse can remain on the mortgage, even when a change to ownership with a quitclaim. If you intend to remove an individual from a mortgage, refinancing the mortgage is required. In cases where there are more complex property transfers, multiple parties are included in a land claim.

Title Defects and Clearing Previous Liens or Claims

In some cases, a property’s title may include a lien or claim on a previous owner and claim land or real estate. If there is an unreleased lien or document on a property title, this could render the current ownership invalid. A quitclaim deed can clear the title and release previous liens and claims. This situation may occur with a foreclosed property where a previous owner defaulted on mortgage payments.

When some ownership and property claim documents are missing or incomplete, this may raise concerns about who owns or has a claim to the land. When you have a previous owner sign a quitclaim deed, this clears any issues of title ownership and allows for the transfer of the title.

How to Create a Quitclaim Deed

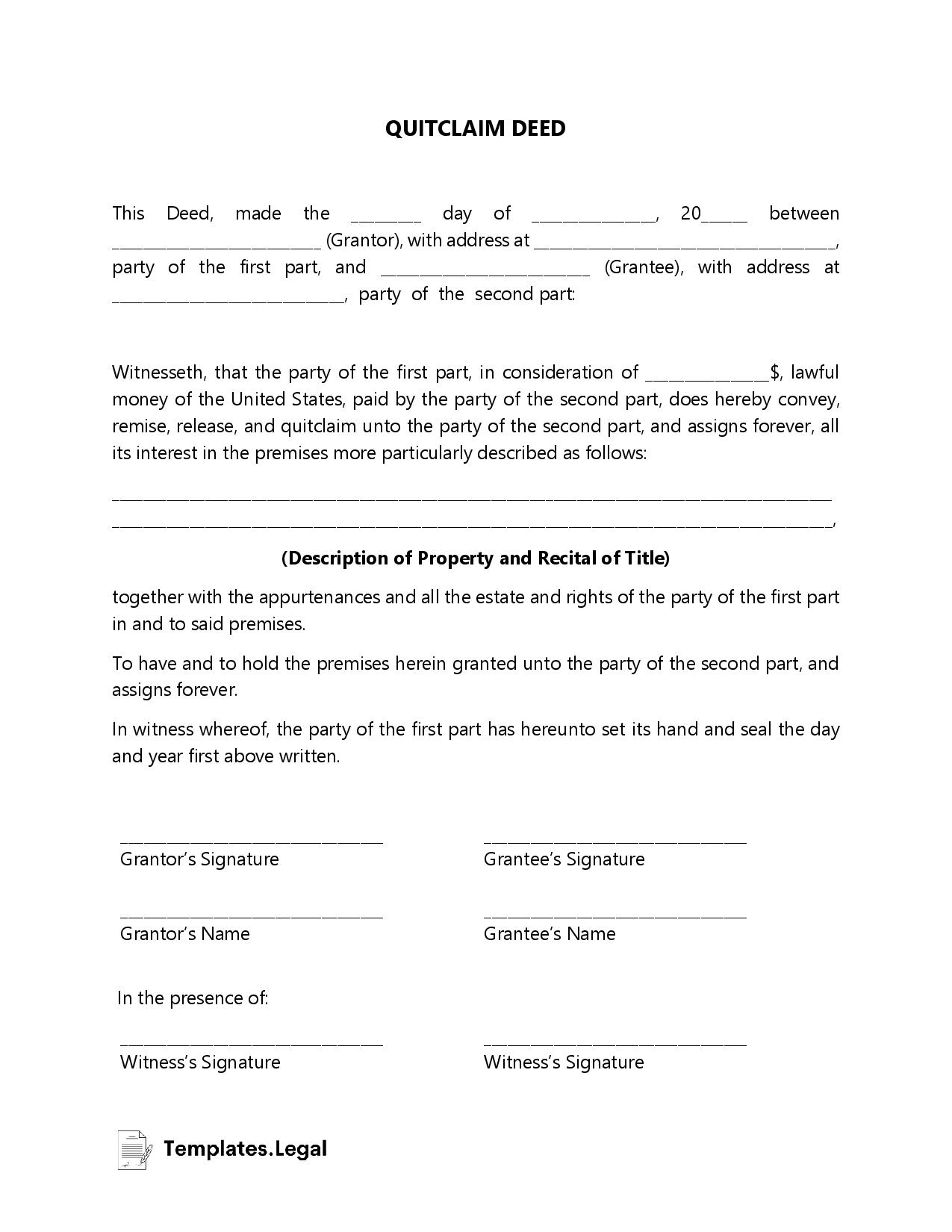

You can create a quitclaim deed online by using a standard template or website with step-by-step instructions. You’ll also find examples of quitclaim deed forms online for reference. It’s an easy process that requires just a few steps, including:

- Indicate the type of property involved in the transfer (commercial, residential, or land). Property may include undeveloped land.

- Select the state and county where the property is located. If you’re using an interactive website, this process will generate a custom form based on the property deed requirements for quitclaim forms.

- Clarify whether you’re transferring or selling the title or if you are the recipient or buyer of the property.

- The form will require details on whether the property or real estate will be transferred to an individual, multiple parties, a corporation, or held in trust. Your full name, address, and marital status are also required. If there are multiple grantees or grantors involved, the form should provide additional space or the option to add lines to provide details.

- The price of the property for sale must be disclosed.

- Besides providing the county and state of the property or land, you’ll need to provide a description. Property details include lot number(s), the condition of the land (if undeveloped or underdeveloped), specific blocks, roads, or streets included in the land, survey numbers, and other helpful information.

- You may customize the form to indicate who will be responsible for receiving tax notices once the property is successfully transferred. This section allows you to enter multiple parties, including the grantor and grantee, who may both receive a copy of tax notices, if preferred.

- Other details required on the quitclaim deed form include where the grantor intends to sign the form (in the same state where the property is located or another location) when the deed is expected to be signed (add a specific date or indicate if this is uncertain), and other information, which includes formatting the appearance of the form, before reviewing printing, and signing.

- Once the form is ready and printed, it must be notarized and signed before filing. The cost of submitting a quitclaim deed form is approximately $250. Fees for filing quitclaim deed forms and other types of property deeds vary depending on the documents required and the state.

While some real estate professionals may recommend legal advice to prepare a property deed, quitclaim deeds are more accessible and less complex to prepare than general warranty deeds and other transfers of property.

If a property transfer requires a deed of trust and amendments to the mortgage and other agreements, consulting with a real estate lawyer or consultant is an excellent option to consider before proceeding.

The Difference Between Quitclaim Deeds and General Warranty Deeds

While quitclaim deeds are convenient and fast for grantors, there are distinct differences between this agreement and warranty deeds or special warranty deeds. A quitclaim deed doesn’t guarantee any liens or claims attached to the property, which means it may not be the best option for new titleholders.

Since quitclaim deeds are quick and easy to file, there is no guarantee that another party or interest will claim ownership, even once you purchase real estate. This type of deed allows new parties to take ownership of the property, even with the risk that other entities may submit a claim. Quitclaim deeds do not require a title search, which is needed when you file a general warranty deed.

Quitclaim Deeds Provide Greater Flexibility for Tax Payments

If you file a property claim in some states, this process may initiate tax payments, even in cases where land or real estate is transferred to a family member or individual as a gift. In this situation, a real estate consultant may recommend using a quitclaim deed, as the flexibility of this document allows you to change the wording to exempt the new title owner from transfer tax.

Quitclaim deeds can include individuals, joint ownership, and corporations. This type of deed offers more flexibility than special warranty deeds and general warranty deeds. It’s relatively easy to find quitclaim deed templates online, where you can fill out each section with step-by-step instructions and links to further assistance and legal support.

Canceling or Revoking a Quitclaim Deed

Once a quitclaim deed form is notarized and filed in the appropriate district, it cannot be canceled or revoked. In some cases, where there is undue influence or similar circumstances, a court may decide that revoking a claim or transfer of property is warranted. If there is an amicable relationship between the grantor and grantee, changes to the deed or complete revocation are possible without court involvement.

If you’re uncertain whether to proceed with a quitclaim deed form or there are concerns about the process, it’s best to consult with a real estate lawyer or consultant. It’s essential to obtain legal advice in the event of divorce or circumstances where family members may contest land ownership or other complications may arise from filing a deed.